Source: Global Economic Health Check, U.S. Bank Asset Management Group, May 19, 2023.

Weekly market analysis

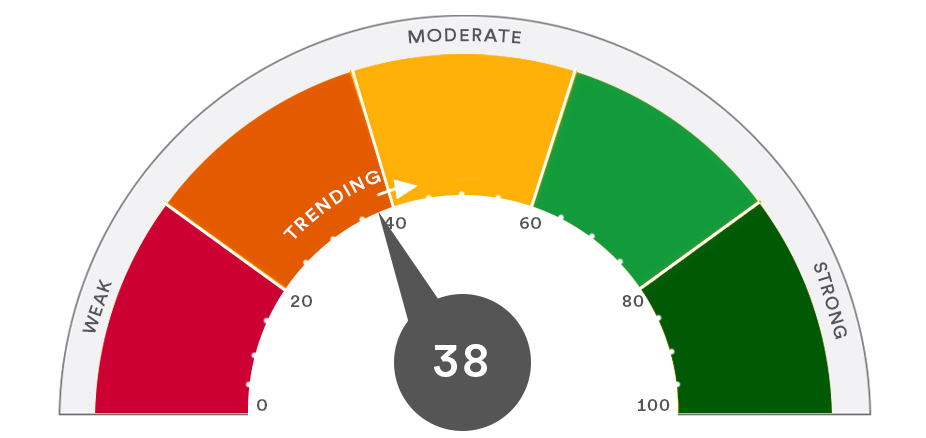

Stocks rose last week, despite the breakdown in debt ceiling negotiations and market expectations of higher interest rates for longer. Performance remains skewed toward growth-oriented stocks as U.S. economic data moderates.

Q2 2023 investment outlook: Navigating volatile asset prices and capital markets

The current capital market environment includes questions about financial sector health, global interest rate policy and economic trajectory. Get answers in the quarterly investment outlook.

News and updates

Stay informed on key topics likely to impact markets, the economy and investors.

The debt ceiling debate in focus

May 19, 2023

With the U.S. government’s authority to borrow money bumping up against the federally mandated debt limit this year, is a political confrontation brewing that could impact capital markets?

The impact of today’s higher interest rates on the housing market

May 23, 2023

The Federal Reserve’s aggressive war on inflation is slowing the housing market and curbing investor appetite for real estate. Learn how this could impact the broader economy and investors.

Investors focus attention on corporate earnings

May 23, 2023

What do corporate earnings reveal about the direction of the economy and markets in 2023?

How does consumer spending impact the health of the economy?

May 18, 2023

In a delicate balancing act with a Federal Reserve intent on slowing the economy to fight inflation, steady consumer spending has helped avoid a recession. But does record household debt threaten to tip the scales?

Analysis: Assessing inflation’s impact

May 12, 2023

While the pace of rising inflation is slowing, persistently higher prices continue to weigh on consumers and policymakers alike.

Is the economy at risk of a recession?

May 11, 2023

The Federal Reserve is focused on fighting inflation with ongoing policy moves intended to slow consumer demand. Does this put the economy at risk of a recession?

How rising interest rates impact the bond market

May 9, 2023

With the Federal Reserve increasing interest rates to get inflation under control, what opportunities does this create for bond investors?

The effect of the job market on the economy

May 8, 2023

Set against the backdrop of a slowing economy, the strong job market has drawn the attention of the Federal Reserve as it adjusts monetary policy to help curb inflation.

How do rising interest rates affect the stock market?

May 5, 2023

With interest rates continuing to go up this year, learn what the likely ripple effects across capital markets may mean for investor portfolios.

Federal Reserve focuses monetary policy on fighting inflation

May 4, 2023

With the Federal Reserve raising short-term interest rates and no longer providing liquidity to the bond market, investors should prepare for change as the Fed continues to battle inflation.

Federal Reserve delivers 0.25% interest rate hike following May’s FOMC meeting

May 3, 2023

As widely anticipated, the Federal Reserve increased its target federal funds interest rate today by 0.25% to a range of between 5.00% and 5.25%. Learn what this may mean for markets, the economy and investors.

How to invest in today’s market

May 3, 2023

The U.S. Bank asset management group anticipates that tighter monetary policy will contribute to decelerating economic growth this year, with inflation remaining a concern.

Is the market correction over?

May 1, 2023

Last year’s bear market appears to have given way to a stock market essentially stuck, with prices fluctuating in a relatively narrow trading range.

Analysis: China’s economy and its influence on global markets

April 26, 2023

What considerations should investors seeking emerging market exposure pay attention to as China’s economy gains momentum following economic reopening?

How to put cash you’re keeping on the sidelines back to work in the market

April 24, 2023

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.

Treasury yields invert as investors weigh risk of recession

April 24, 2023

What does an inverted yield curve say about the economy’s prospects for a recession?

Tactical asset allocation in a challenging market

April 24, 2023

Consider these tactical asset allocation strategies to help enhance the potential for investment returns and manage overall portfolio risk.

Financial planning considerations when inflation is high and interest rates are rising

April 18, 2023

Persistent inflation and rising interest rates can affect your ability to meet your financial goals. Consider a few specific actions to take if you’re looking to help generate income to meet cash flow needs or growth in your portfolio.

The fluctuating value of the U.S. dollar and what it means for investors

April 17, 2023

Taking measure of global currency trends as you position your investment portfolio.

Investing in tech stocks: Is now a good time?

April 13, 2023

After an abysmal 2022, tech stocks are up this year – outperforming the broader S&P 500 by a wide margin. What does this mean for investors?

How commodity prices can impact markets and inflation

March 28, 2023

What opportunities does today’s volatile commodities market offer investors?

Russia-Ukraine conflict and its continued impact on global markets

March 23, 2023

As the most significant military conflict in Europe since World War II drags on, the Russia-Ukraine war continues to impact global markets in significant ways.

Capital markets gauge financial sector contagion risk

March 13, 2023

Our investment strategists assess capital market implications stemming from the recent failures of Silicon Valley Bank and Signature Bank.

Stock market under the Biden administration

March 6, 2023

Explore how capital markets have fared so far under the Biden administration and discover what to expect during the rest of the president’s first term in office.

How do supply chain issues contribute to inflation?

February 21, 2023

While constraints have eased, ongoing supply chain issues continue to exert an inflationary influence on some sectors of the global economy.

Media mentions

Treasury yields climb as debt ceiling talks in spotlight

5.16.2023 | Reuters | Article

“There is a question whether there's enough time to get a full deal done rather than a temporary extension, but it doesn't mean they can't come to an agreement in a few weeks,” said Tom Hainlin, national investment strategist at U.S. Bank Wealth Management in Minneapolis.

Lisa Erickson explains why the Federal Reserve is likely to pause rate hikes in June

5.13.23 | Fox Business | Video

U.S. Bank Wealth Management's Lisa Erickson discusses how 'credit tightening' may add financial stress to the economy.

Markets gearing up for recession?

5.12.23 | Bloomberg | Audiocast

Eric Freedman, CIO at US Bank Wealth Management, discusses the investment environment, banking issues and outlook for the economy.