Key takeaways

Higher inflation and a changing interest rate environment contribute to headwinds for the stock market.

As a result, stocks underwent a significant repricing in 2022 and challenges continue in 2023.

How corporate earnings hold up will influence the direction of stocks.

A combination of rising interest rates and persistently high inflation continues to create headwinds for stocks.

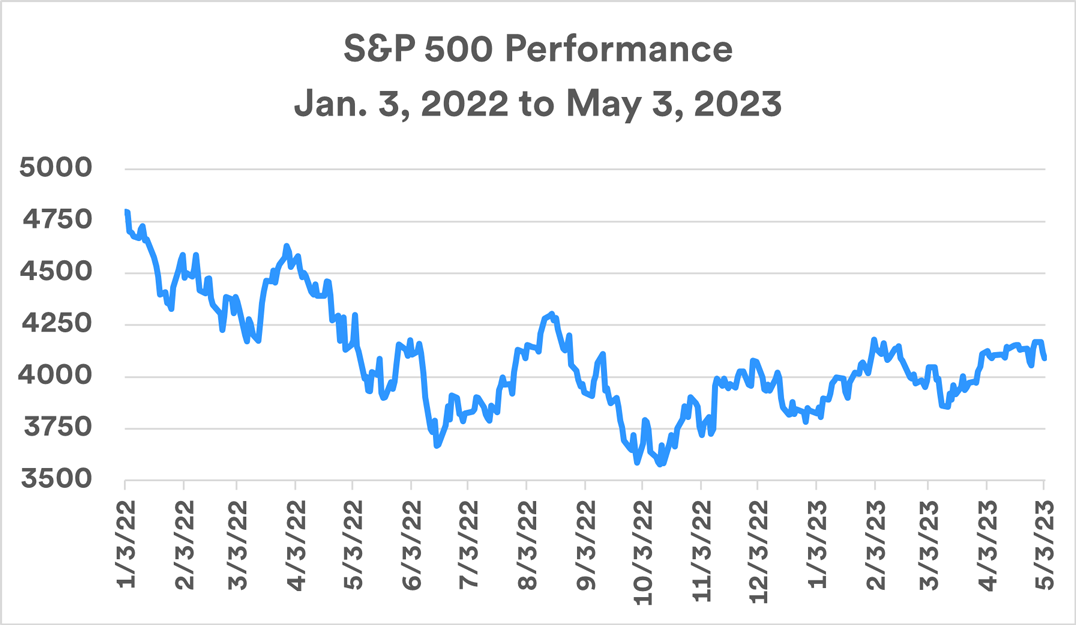

A significant "repricing" occurred in the stock market beginning in 2022, and the Standard & Poor’s 500 stock index, a key indicator for U.S. equities, slipped into a bear market, representing a decline of 20% from its peak value, as did other major market indices. The market has regained some of the ground it surrendered in October 2022, but is still well below peak levels at the start 2022.

Source: WSJ.com. Chart depicts daily changing values of the Standard & Poor’s 500 Index, an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

The Federal Reserve (Fed) sought to ease the inflation threat through its monetary policy moves. These measures included dramatic increases in the short-term target federal funds rate, from near zero percent to 5.00% to 5.25% by May 2023. Another step by the Fed was to reduce its bond holdings, removing significant liquidity from bond markets. The Fed’s moves are designed to slow the rate of economic growth, with the goal of lowering inflation, ideally without pushing the economy into a recession.

Rising interest rates altered conditions for equity investors who had become accustomed to an extended low-interest rate environment. What happens when interest rates are elevated and what does this mean for your own investments?

The Fed’s previous “easy money” stance

The change in the underlying stock market environment stands in sharp contrast to the fairly favorable economic landscape that dated back to the waning days of the financial crisis in 2009. During that decade-plus stretch, low-interest rates and moderate inflation prevailed. In such an environment, risk assets including stocks, reaped the benefits. “Supportive monetary policy was critical for risk asset owners, whether it be in domestic equities or real estate,” says Eric Freedman, chief investment officer for U.S. Bank. The stock market enjoyed impressive gains of 18.40% in 2020 and 28.71% in 2021.

“As the Fed tightens interest rates, we can expect a decline in economic growth.”

Eric Freedman, chief investment officer, U.S. Bank Wealth and Institutional Asset Management

The U.S. economy, as measured by Gross Domestic Product (GDP), also performed well over most of this period, capped by a growth rate in 2021 of 5.9%, its strongest calendar year for growth since 1984.1 That helped the Fed make progress in meeting one of its mandates, achieving an economy with “maximum employment.”2 Employment trends remain generally positive today, with solid job creation and low unemployment.

For the better part of the past four decades, inflation and interest rates were relatively low. Although volatility was periodically an issue, this was a mostly positive stretch for equity investors. The question going forward is the degree to which the challenging environment that exists today will continue.

Inflation’s resurgence tips the scales

A sudden surge in the inflation rate prompted a change in the Fed’s monetary stance. In 2021, the cost-of-living as measured by the Consumer Price Index rose 7%. Inflation over the 12-month period that ended in June 2022 reached 9.1%, the highest increase in annual living costs since 1981. Inflation has since tapered off but remains elevated, with CPI measuring 5.0% for the 12-month period ending in March 2023.3 This far exceeds the Fed’s long-term annual inflation goal of 2%.

Changes in the bond market reflect the Fed’s policy shift. The yield on the 10-year U.S. Treasury note, a benchmark of the broader bond market, rose from 1.52% at the end of 2021 to more than 4% in October 2022, its highest level in more than a decade.4 The 10-year Treasury yield has settled in a range from 3.30% to 4.10% in recent months. Yields on the 3-month U.S. Treasury bill (more closely related to the fed funds rate) jumped dramatically, from 0.06% on December 31, 2021 to 5.10% at the close of April 2023.

Higher rates alter the equity market landscape

There are various reasons why increasing interest rates can have an impact on equity markets. For example, it could affect future earnings growth for U.S. companies. “As the Fed tightens interest rates, we can expect a decline in economic growth,” says Freedman. In fact, GDP growth slowed considerably in 2022, growing at 2.1% (compared to 5.9% in 2021). In the first quarter of 2023, the economy grew at an annualized rate of just 1.1%.1 Economic weakness can slow down business activity, which potentially detracts from corporate earnings, and ultimately pressuring stock prices.

Another reason stocks may underperform, as interest rates rise - bonds, certificates of deposit and other vehicles pay more attractive yields. “If interest rates move higher, stock investors become more reluctant to bid up stock prices because the value of future earnings looks less attractive versus bonds that pay more competitive yields today,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “Present value calculations of future earnings for stocks are tied to assumptions about interest rates or inflation. If investors anticipate higher rates in the future, it reduces the present value of future earnings for stocks. When this occurs, stock prices tend to face more pressure.”

“Most of the hardest hit stocks in 2022 were those with premium price-to-earnings (P/E) multiples,” says Haworth. In other words, stocks that are considered “pricey” from a valuation perspective suffered the largest price declines. This included secular growth and technology companies that enjoyed extremely strong performance since the pandemic began. Haworth notes that prior to the Fed’s policy shift, a number of stocks that generated little to no current earnings saw their stock prices inflated as investors focused on future earnings potential. “Markets are less likely to ‘pay up’ for stocks that are unable to generate meaningful current earnings if higher interest rates persist,” says Haworth.

An additional factor creating challenges for equity markets, according to Haworth, is higher debt costs (resulting from elevated interest rates) can cut into corporate profits. “Companies that have to roll over debt in today’s market must pay more for that debt.” That opens the door, says Haworth, to the potential for reduced corporate earnings going forward. Lower earnings are typically reflected in lower stock prices.

A cloudy equity market outlook

The Fed has already raised interest rates three times in 2023, following seven rate hikes in 2022. While Fed Chair Jerome Powell in early May indicated that the Fed may be ready to pause rate hikes at its next meeting in June, he also stated that rates will remain elevated for a period of time. According to Powell, “it would not be appropriate to cut rates and we won’t cut rates,” at least for now.5 Inflation’s growth rate slowed since mid-2022, but it continues to exceed the Fed’s target. “It’s clear that the Fed policy shift created great change in the markets,” says Bill Merz, head of capital market research at U.S. Bank Wealth Management. Merz notes that the Fed faces a difficult balancing act, trying to temper growth sufficiently to tamp down inflation without causing a recession.

It should be noted that a changing interest rate environment, while creating more headwinds for stocks, doesn’t eliminate potential upside opportunity. “The key is how well companies perform,” says Haworth. “One of the variables we’re watching is whether inflation declines sufficiently so that stock valuations are still considered reasonable given the underlying environment.” Haworth notes that a return to lower inflation would generally benefit stocks.

Nevertheless, there are reasons to ready for the prospect of additional asset repricing similar to what propelled stocks into bear market territory in 2022. Haworth says the issue now is how corporate earnings hold up in a slow growth economy with persistent inflation pressures and elevated interest rates. “To bid stock prices higher, investors need to believe that earnings will grow faster than is indicated by current expectations, and generate more attractive growth potential than the current elevated yields on fixed income instruments.”

Putting your portfolio into perspective

As you assess your own circumstances, it’s fair to anticipate that equity markets may continue to exhibit price volatility in the near term. Nevertheless, assuming the Fed succeeds in tempering inflation and the economy ultimately recovers, stocks will continue to represent a key component of any balanced portfolio for long-term investors.

Talk with your wealth professional about your current comfort level with your portfolio’s mix of investments and discuss whether any changes are appropriate in response to an evolving capital market environment.

Note: The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

Tags:

Related articles

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.

Analysis: How persistent might inflation be?

Inflation spiked sharply over the past year. Learn what this could mean for your finances and if there’s any end in sight to higher prices.