Key takeaways

Consider tactical asset allocation, which involves making modest, temporary adjustments within your investment portfolio relative to your long-term target allocation.

Dollar-cost averaging, which involves investing a portion of the cash balance into the target portfolio through regular intervals, may help to manage investment risk as the market moves up and down.

Rebalancing among asset classes with the most significant differences in return and risk, such as stocks and bonds, can enhance the potential for long-term returns and is effective at managing portfolio risk.

A challenging investment environment emerged in 2022 and persists in the first half of 2023. Throughout most of 2022, investors found few safe havens, as most major asset classes, including stocks and bonds, suffered setbacks. That’s unusual, as historically, for example, bond markets have often provided positive returns within a diversified portfolio to help offset a downturn in stocks. However, high inflation, rising interest rates and the Russia-Ukraine war all contributed to downward pressure on both bond and stock prices. In the opening months of 2023, bond and stock markets regained some of the ground lost in 2022, but the environment remains volatile. Challenges may persist in a period with elevated inflation and interest rates and the potential for slower economic growth.

“It’s important to recognize that the market environment and the underlying economy are different today from what existed prior to 2022.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

“It’s important to recognize that the market environment and the underlying economy are different today from what existed prior to 2022,” says Rob Haworth, senior investment strategy director at U.S. Bank. “With that in mind, it may be a time to consider whether a portfolio designed to meet your long-term investment plans and goals requires adjustment.”

Here are three situational approaches to consider in the current market environment:

- Tactical asset allocation. It could be beneficial to consider modest, temporary asset allocation adjustments within your investment portfolio relative to your long-term target allocation. These adjustments reflect our current assessment of capital market trends and relative risk and return opportunities among asset classes. “The fixed income market offers investors improved opportunities. Yields on bonds, including short-term bonds, are much higher than was the case prior to 2022,” says Haworth. “This may be an opportunity for some investors to earn reasonable returns in a lower-risk asset class.”

- Dollar-cost averaging. Investors often accumulate cash in their portfolios through interest, dividends, or perhaps through security or business sales proceeds. Investing cash into higher returning asset classes such as equities is critical in meeting long-term financial goals. Volatile markets can affect investors’ willingness to put lump sums to work in assets subject to fluctuation such as stocks. Dollar-cost averaging1 is a strategy that may increase your comfort level with equity investing during volatile times. This involves investing a portion of your cash balance into the target equity portfolio through regular intervals rather than trying to invest the cash all at once (a practice called lump-sum investing). “While our research shows that lump-sum investing produced the highest average historical returns, dollar-cost averaging is way to get money invested without experiencing the regret that would occur if markets decline immediately after investing a lump sum,” says Haworth. Regularly directing assets from cash into the target portfolio of equities and other holdings, for a period of six months to two years, may reduce the risk of a large portfolio setback in a brief period of time.

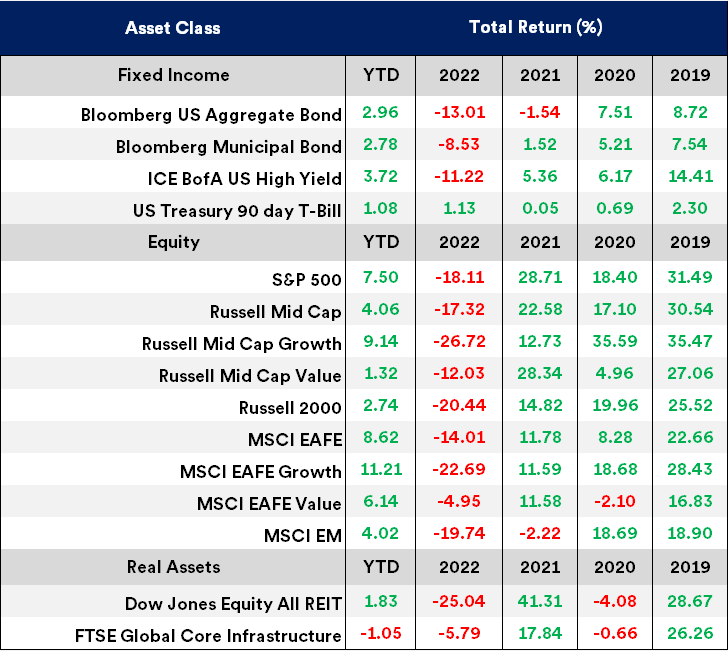

- Rebalancing. Investors should consider regularly rebalancing2 their portfolios. Asset prices can move in different directions and at different speeds, and these return variations can cause your portfolio allocations to drift from your long-term strategy. Given recent market volatility, it’s possible that your portfolio’s current structure is misaligned with your long-term goals. The table below details performance across a variety of asset classes (represented by market indices) through March 31st, 2023. Our analysis finds periodic rebalancing across asset classes with the most significant differences in return and risk, such as stocks and bonds, enhances long-term returns and is effective at managing overall portfolio risk. We first suggest evaluating your relative stock/bond allocation and using recent significant performance differences to nudge your portfolio back toward its target allocation. Additionally, within an asset class such as mid-cap U.S. stocks, we suggest examining allocations where growth and value style performance has materially diverged. Notably, some growth-oriented S&P 500 sectors, such as Technology, that were hard hit in 2022 bounced back in 2023’s first quarter. Even in that short period of time, you might find some of your portfolio positions out of balance. “Make sure you own what you want to own,” says Haworth. “If you have significant positions in assets that have become expensively valued, you may want to reposition those holdings as a way to help manage portfolio risk.”

YTD Period ending 3/31/2023. Source: Morningstar. See index descriptions in the disclosure. Past performance is no guarantee of future results. Returns shown represent results of market indexes and are not from actual investments and are shown for ILLUSTRATIVE PURPOSES ONLY.)

As you seek to properly position your portfolio, consider tactical adjustments to take advantage of specific opportunities that have emerged in today’s market. These include dollar-cost averaging of your available cash to put money to work systematically over time and limit the potential downside risk of a large, lump-sum investment. And rebalancing your portfolio positions to align your asset mix with your long-term goals and risk tolerance.

Your wealth management professional can be instructive in helping you blend and select strategies to keep your portfolio on target to meet your long-term investment plans and goals through today’s challenging market environment.

Tags:

Related articles

Financial planning considerations when inflation is high and interest rates are rising

The resurgence of inflation combined with rising interest rates creates challenges for investors in 2022. These tactical considerations can help you navigate today’s unique market dynamics.

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.