Key takeaways

The U.S. government could exhaust its ability to borrow money as early as June 1, 2023, without a debt ceiling extension.

Divided partisan control of Congress raises questions about the timely passage of legislation to raise the debt ceiling.

After days of reported progress in negotiations between Democratic and Republican leaders, talks were paused on May 19th.

With deadlines fast approaching for the U.S. Congress to raise the debt ceiling or face defaulting on the nation’s financial obligations, an increasing sense of urgency appeared to spur negotiations between leaders of the Democratic and Republican parties. After reports of progress in mid-May, negotiations were paused on May 19, an indication that significant hurdles to an agreement remain. Prior to that time, both White House officials and Congressional leaders voiced optimism that a workable resolution allowing the government to continue paying its bills was within reach. The announced pause raised questions as to whether Congress can act in a timely fashion to avoid a federal government default.

The debt ceiling requires frequent adjustments for the federal government to continue to borrow to pay its bills. While this is often a routine process, the issue became contentious in 2023. Republican leadership in the House clashed with Democratic leadership in the Senate and Democratic President Joe Biden as the U.S. Department of the Treasury tries to stretch spending as long as possible pending final resolution by policymakers.

The federal government’s debt-issuance authority expired in January 2023. At that time, the Treasury Department began implementing so-called “extraordinary measures” to avoid a default on the government’s bills. However, Treasury Secretary Janet Yellen warns this stop-gap measure could be exhausted as early as June 1, 2023.1

What is the debt ceiling?

The federal debt is the total amount of money the government owes for spending on everything from Social Security and Medicare to defense programs and other types of domestic and overseas expenditures. The debt limit set by Congress represents the funds that the U.S. Treasury is authorized to raise through debt security offerings to pay the government’s operating costs.

Although it’s a somewhat arcane procedure, raising the debt ceiling allows the U.S. Treasury to continue debt issuance to pay for Congressionally-approved federal government spending. “Increasing or suspending the debt limit does not authorize new spending commitments or cost taxpayers money,” explains Yellen. “It simply allows the government to finance existing legal obligations that Congresses and Presidents of both parties have made in the past.”2

The need for such Congressional action has occurred nearly one hundred times since World War II. Most often, passage is a routine piece of business for legislators, but in some years, it becomes more of a political issue. Congress struggled with this matter in 2021, and after protracted negotiations, finally extended the debt ceiling limit to a level that allowed continued issuance of Treasury debt securities into early 2023.

What happens if Congress doesn’t raise the debt ceiling?

How long can Treasury officials hold out until Congress extends the debt ceiling before reaching its debt-issuing limit? The primary method of meeting current obligations, according to Yellen, is to suspend new investments of government pension programs until early June 2023. She says after the debt limit impasse ends, all of these retirement programs will be fully funded.

Along with delaying selected expenditures, cash receipts taken in by the government, in the form of taxes, also helps extend the calendar before Congress acts. Significant tax receipts occurred when the individual tax filing deadline (April 18, 2023) arrived. That helped finance some of the government’s current bills. “Quarterly corporate taxes may again extend the deadline a bit longer,” says Kevin MacMillan, head of government relations at U.S. Bank. “The major concern about the issue dragging out is that many Republicans have stated they won’t vote for a debt ceiling extension without meaningful spending cuts.” MacMillan says this adds uncertainly to the timing of necessary Congressional action.

On April 26, 2023, the Republican-controlled U.S. House narrowly passed a bill allowing for a debt ceiling extension, but combined that measure with a plan for significant cuts to domestic spending programs. The legislation, titled the Limit, Save and Grow Act calls for extending the debt limit until March 31, 2024, less than one year from now. Tied to the extension are spending cutbacks on discretionary domestic programs.

Without a debt ceiling extension, the U.S. risks defaulting on its debt. While Yellen indicated this so-called “X” date could be as soon as June 1, that is not a definitive deadline. Yellen notes, “federal receipts and outlays are inherently variable, and the actual date that Treasury exhausts extraordinary measures could be a number of weeks later than these estimates.”1 This means the actual deadline could be later in June or in early July. Yellen warns of negative consequences if Congress is unable to come to a debt ceiling agreement in a timely manner. According to Yellen, “Failure to meet the government’s obligations would cause irreparable harm to the U.S. economy the livelihoods of all Americans, and global financial stability.”2

Negotiations between leaders of both parties have been underway in recent weeks. After discussions on May 16, 2023, both President Biden and House speaker Kevin McCarthy, indicated confidence that while an agreement has yet to be reached, a debt default will be avoided. However, neither side has been clear about the path to an agreement, and only days later, negotiations appeared to be at least temporarily sidetracked as talks broke off. The pause in talks between Democratic and Republican leaders contrasted to earlier comments from McCarthy that the House may be able to vote on a package in a matter of days. MacMillan says the idea that a last-minute deal will be reached is consistent with past debt ceiling disputes. Even when deadlines were threatened, an extension was always approved before the government defaulted.

An alternative suggested by some is that President Biden take unilateral action to resolve the crisis. One example is for the President to claim that the debt ceiling process is a violation of the 14th amendment to the U.S. Constitution that states “the validity of the public debt of the United States…shall not be questioned,” opening the door to authorize additional debt issuance. This and other possible measures some pundits believe to be options available to the Biden administration would likely be challenged in court – while contributing to the potential for more market volatility.

Some perspective on the debt ceiling debate

This repeated and ongoing issue creates stress for capital markets, even with Congress’ track record of ultimately voting to raise the debt ceiling. “The issue itself is temporary, and ultimately, government spending catches up,” says Rob Haworth, senior investment strategy director at U.S. Bank. “The bigger question is what it might mean for the economy and financial markets.”

“While the debt ceiling potentially raises issues for the bond market, investors may also become concerned with the level of debt that continues to emerge in the current federal spending environment.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

The most direct concern is that without the debt ceiling expansion, the government risks defaulting on its Treasury obligations. “Such a move could cause creditors to demand higher interest rates from the U.S. Treasury in order to provide capital,” according to Haworth. If that occurs, it could result in subsequent rate increases for other types of debt, including mortgages, consumer borrowing and business capitalization.

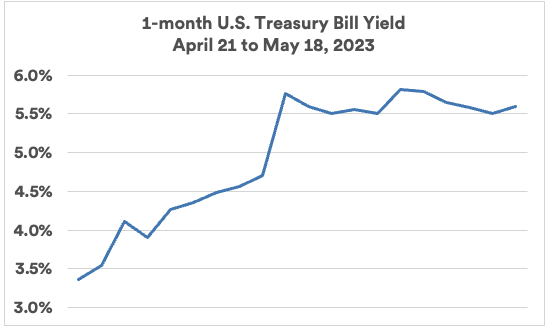

Fears related to the debt ceiling impasse appeared to contribute to instability in the short-term Treasuries market. Yields on one-month U.S. Treasury bills shot higher in a short period of time, from 3.36% on April 21 to 5.79% on May 12. The spike in yields demonstrate a reluctance among investors to put money to work in 1-month Treasury bills, reflecting market concerns about the near-term default risk.

Source: U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates.

Source: U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates.

Haworth notes that to this point, there’s been little stress in equity markets while negotiations continue, as stock investors demonstrate confidence that policymakers will ultimately reach a timely agreement. He points out that once the Treasury department is authorized to issue new debt, more investment capital may be shifted to bonds, which could temporarily reduce stock market liquidity and contribute to equity market volatility.

Historical precedence

A similar impasse occurred in 2011, when Republicans in Congress squared off against Democratic President Barack Obama over the debt ceiling issue. At that time, capital markets proved to be very volatile as the deadline for legislation approached. Two days before the date when the Treasury Department estimated that it would run out of funds using extraordinary measures, Congress voted to raise the debt ceiling.

Another consequence of that dispute, however, was a major credit rating agency’s downgrade of U.S. Treasury securities below the highest, triple-A level for the first time in history. That appeared to cause higher interest rates on U.S. Treasuries as a result.

“While the debt ceiling issue potentially raises challenges for the bond market, investors may also become concerned with the level of debt that continues to emerge in the current federal spending environment,” says Haworth. He suggests that at some point in the future, the amount of debt that’s been issued will impact the supply-demand balance for bonds, possibly affecting interest rates.

Economic and market considerations

If the debt ceiling issue again reaches a critical point and becomes difficult to resolve on a timely basis, it could cause a hit to the economy, though the damage may be short-lived. “Typically, one of the first spigots to be shut off is salaries to federal workers,” says Haworth.

Ultimately, the pain may spread to those who receive direct payments from the government, such as Social Security recipients. “There are short-term impacts from that,” says Haworth, “but once funding is restored, the government fulfills its obligations.” He points out that while this can create financial difficulty for many, the overall impact to the economy, historically, has been modest.

Adds Eric Freedman, chief investment officer at U.S. Bank, “This looks to be more of a short-term issue. There’s nothing specifically we as investors can do to prepare for what’s ahead as this issue plays out.” Freedman points out that no significant long-term consequences resulted from the credit rating downgrade in 2011, despite its unprecedented nature.

Managing the government’s budget

As is often the case with other issues, the legislative agenda captures significant headlines from time-to-time. A positive sign for investors is that the looming debt default deadline pushed the negotiation process forward, which investors hope will lead to a timely debt ceiling extension. It represents just one factor to consider as you assess how your own portfolio is situated given the current environment and your long-term financial goals.

Talk to your financial professional if you have questions or want to discuss your particular situation.

Tags:

Related articles

Is the economy at risk of a recession?

The Federal Reserve is focused on fighting inflation with aggressive policy moves intended to slow consumer demand. Does this put the economy at risk of a recession in 2023?

Q2 2023 investment outlook: Navigating volatile asset prices and capital markets

The current capital market environment includes questions about financial sector health, global interest rate policy and economic trajectory. Get answers in the quarterly investment outlook.