Webinar replay: Spring investment outlook

At a glance

Asset prices remain volatile following 2022’s gyrations that saw both stocks and bonds simultaneously decline in value over a calendar year for the first time since stock and bond index measurement began. The current capital market environment includes questions about financial sector health, global interest rate policy and economic trajectory. Investors await answers to these questions, but we expect more waiting for definitive answers and likely more volatility ahead.

Our overall view remains that the confluence of higher interest rates inside a resilient yet gradually slowing economic landscape will lead to a tougher corporate profit backdrop. That said, we anticipate a more shallow dip in corporate and consumer activity, shaped by how high central bank target interest rates ascend to thwart inflationary pressures and how long those rates remain elevated. Higher interest rates pressure asset prices, consumer and business demand, and as we have witnessed with recent banking sector casualties, elevated interest rates can adversely impact functioning within select institutions. If we see less credit extension and tighter financial conditions, economic growth impulses may further decline, hampering consumer and business activity. We anticipate the Federal Reserve and other major central banks to remain steadfast in their attempts to thwart inflation through higher interest rates, the current financial sector issues to remain contained and for economic growth to weaken but not to a point of a prolonged recession, per our U.S. Bank Economics group’s forecast. Investors tend to overshoot with optimism and pessimism, and we expect opportunities to emerge as answers evolve in coming quarters.

― Eric Freedman, Chief Investment Officer, U.S. Bank

Global economy

Quick take: The global economy started 2023 on a solid note, with a warm winter and softer energy prices supporting consumer activity, though recent bank failures raise growth concerns. China’s “reopening” from coronavirus lockdowns may provide a lift later this year, though the broad trend is toward slow growth along with elevated inflation.

- Continued strong U.S. consumer spending registered in early 2023 is likely to slow but solid consumer and business balance sheets may mean the U.S. avoids recession for now. Manufacturing and housing market activity are softer and loan growth is slowing, though consumer spending and services businesses remain solid. Additionally, recent failures of Silicon Valley Bank and Signature Bank may temper future loan growth. This slowing should ease inflation pressures, but price gains likely remain well above the Federal Reserve’s (Fed) 2% inflation target, supporting still-modest U.S. growth.

- Easier energy costs should help foreign developed economies avoid a recession for now. Interest rate hikes from the European Central Bank and the Bank of England should dampen growth, with the United Kingdom likely to enter a modest recession. However, improving business sentiment for the region and China’s reopening should boost trade prospects over the year.

- Emerging market economies likely see recovery in 2023, led by China’s reopening and easing inflation pressures. China’s reopening from COVID-19 restrictions led a recovery in travel for the Lunar New Year holiday. Consumer spending is likely to follow in coming quarters, with China’s National People’s Congress setting a 5% target for 2023. China’s acceleration along with a halt to Fed rate hikes should lift growth prospects for other emerging market economies in the latter portion of the year. The Russia/Ukraine conflict and U.S.-China trade issues could weigh on emerging markets’ 2023 economic results.

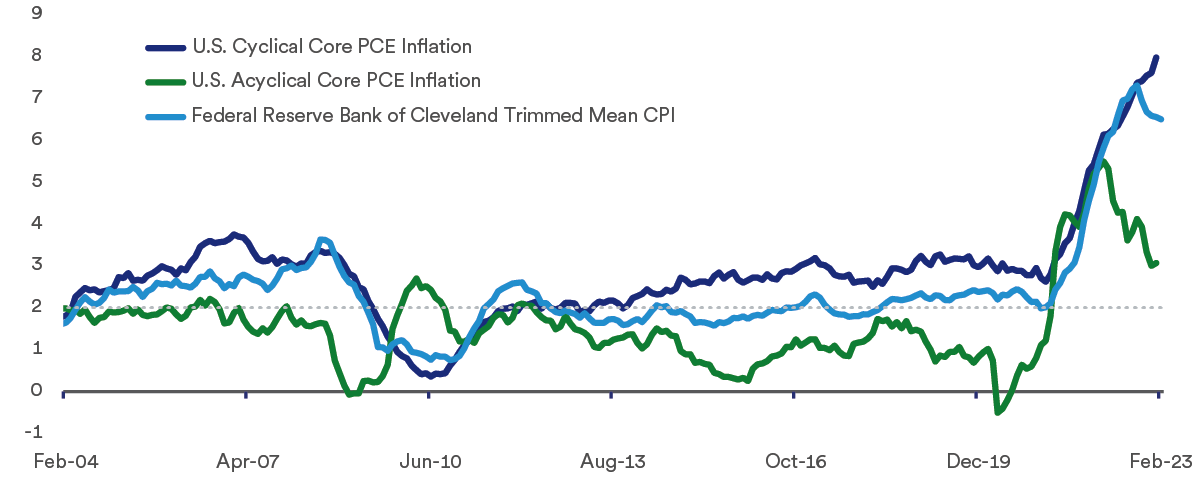

U.S. inflation measures

Sources: U.S. Bank, Bloomberg

U.S. equity market

Quick take: Despite positive first quarter performance, we maintain a cautious near-term outlook for U.S. equities due to persistent inflation, rising interest rates and uncertain 2023 earnings growth while financial stability concerns complicate the Fed’s ongoing battle with inflation.

- U.S. equities trended higher in the first quarter, but returns are varied and volatility is high. Elevated inflation erodes the purchasing power of earnings streams and future dividend payments. Rising interest rates and recent bank failures make higher-yielding safer assets such as U.S. Treasuries more attractive, causing investors to demand higher compensation for taking on equity price risk by paying lower prices relative to anticipated earnings.

- Broad market valuations are fair, neither at high nor low extremes. The S&P 500 currently trades at approximately 18.5 times last 12-months’ (LTM) and next 12-months’ (NTM) earnings projections. We regard broad-market valuations to be within a “zone of okay.” Analysts project S&P 500 earnings of roughly $220 per share for this year, down from the $250 estimate level as of mid-2022. While analysts have moderated 2023 expectations, we expect more downside lies ahead due to economic uncertainty following first quarter earnings reports and forward guidance, which begin in mid-April.

- Consumers are spending on “experiences” while business spending has a technology bias. Consumer spending remains resilient, directed largely toward “experiences” such as travel and entertainment; consumer spending on discretionary items such as home furnishings remain soft. Following fourth quarter earnings releases, company managements cited steady business spending on technology, specifically for software and cloud-related expenditures, although they reported lengthening sales cycles as firms look to leverage current spending levels.

- Traditionally defensive, dividend-paying equities offer near-term appeal when weighing the prospects for a growth slowdown or recession. Dividend-paying equities afford investors with both income and growth potential during times of uncertainty. This also helps offset the effects of inflation in an environment where bonds offer increasingly attractive yields.

- Secular growth sectors remain well-positioned for longer-term growth, bolstered by technological advancements and demographic trends. Fast is getting faster, and speed, scale and efficiencies do not occur without technology. The interaction of artificial intelligence, machine learning, e-commerce, cloud computing, data security and analytics provides a platform for new tools and outcomes that favorably positions companies within the Technology sector.

S&P 500 last 12 months price/earnings ratio

Sources: U.S. Bank, Bloomberg, March 6, 2003

International equity markets

Quick take: Warm weather and sufficient gas supplies helped Europe avoid a winter energy crisis, but persistent inflation, higher interest rates and structural headwinds temper our return outlook for foreign equities.

- Stabilizing earnings estimates and improved investor sentiment provide near-term support for foreign developed equity prices. Europe accumulated sufficient natural gas supplies for the region’s 2022-2023 winter season heating and industrial needs, while a historically warm winter led to lower heating demand. As a result, foreign companies’ 2023 corporate earnings estimates have stabilized, with analysts forecasting a 7% corporate profit growth rate relative to 2022, reflecting a modestly positive outlook. The trend in valuation, or the price investors are willing to pay for anticipated earnings, also evidences improved sentiment toward foreign developed equities as we conclude the first quarter.

- While some near-term concerns have receded, intermediate- and longer-term challenges remain. Elevated inflation continues to erode consumers’ purchasing power, while tightening monetary policy increases companies’ financing costs, impairing profitability potential. Europe and Japan continue to experience slowing or declining population growth, challenging longer-term growth prospects. Finally, secular growth sectors such as Technology, Communication Services and Consumer Discretionary represent a smaller mix in foreign equity markets relative to the United States. While we respect recent positive equity price performance, we continue to view the rally’s durability with some skepticism given ongoing intermediate- and longer-term concerns.

- China’s COVID policy reversal and Fed interest rate increases represent competing influences leading to two-sided potential outcomes for emerging market equities. Chinese authorities have quickly pivoted from restrictive “zero-COVID” policies and the economy recovered faster than expected in February. Elevated household bank deposits accumulated during the pandemic represent significant pent-up consumer demand for domestic and foreign goods and services. However, emerging market firms that need to raise capital are forced to compete with increasingly higher U.S. interest rates. A reopening China and tightening Fed monetary policy highlights two-sided outcomes for emerging market prospects, driving our balanced outlook.

Bond markets

Quick take: High-quality bonds offer compelling return opportunities and can position portfolios for slowing economic growth. Headwinds to bond prices could fade this year as we near a potential peak in the Fed’s policy rate, which would support longer-term bonds, but elevated inflation in the meantime warrants normal interest rate sensitivity.

- Central banks must balance raising interest rates with avoiding financial system stress. More restrictive monetary policy may be necessary to cool inflation, but fear of spreading trouble in the banking sector favors a more patient tightening approach that reacts to evolving financial conditions. Stress on the financial system reducing lending activity may replace the need for additional hikes to slow inflation. Consequently, investors are unsure whether the Fed will continue tightening, with investors anticipating a series of rate cuts beginning mid-year. The Fed and FDIC programs that offer overnight loans to foreign central banks and short-term loans to financial institutions aim to contain financial system stress. The Fed also continues to reduce its Treasury and mortgage bond holdings, further tightening financial conditions.

- Fed policy uncertainty contributes to short-term Treasury yield volatility while long-term yields depend primarily on the Fed successfully slowing inflation. The lagged impact of restrictive Fed policy to slow growth and inflation should support long-term bond prices (holding down yields), but inflation and policy uncertainty fuel bond price volatility. Normal portfolio sensitivity to interest rates helps defensively position portfolios while limiting the impact of bond price swings on near-term returns.

- Near-normal valuations on high-quality corporate and municipal bonds and strong credit fundamentals support future return prospects. Credit fundamentals remain strong in the wake of low yields in 2020 and 2021 that allowed many corporations and municipalities to refinance and extend maturities, but persistently high borrowing rates may eventually stress weaker individual issuers. Changing investor sentiment also remains a risk, particularly for lower-quality bonds. Compelling return opportunities that exist in high-quality bonds due to their high incomes create little incentive to increase exposure to riskier below investment-grade allocations.

- Mortgage bonds not backed by the government and insurance-linked bonds can offer attractive income with unique return sources. Most home loans originated before 2022 remain well-secured by the value of the homes collateralizing them, even if home prices continue to fall somewhat further. Slowing housing activity also limits the supply of new mortgages and supports bond prices. Investor sentiment remains the largest near-term risk. Reinsurance, also referred to as insurance-linked securities, continues to offer compelling yields. Insurance premiums (minus insured losses from natural disasters) drive returns and remain uncorrelated with typical economic cycles that drive stock and bond returns.

Ten-year Treasury yield

Sources: U.S. Bank, Bloomberg, Federal Reserve

Real assets

Quick take: Real asset categories exhibit mixed fundamentals amid varied growth drivers. Private real estate appraisals have been slow to reflect the current property market environment while public markets re-priced quickly. Economic uncertainty increases the attractiveness of global infrastructure’s consistent and growing cash flows, while slowing growth and inflation weighs on commodity prices.

- Decelerating economic growth will likely weigh on property prices, especially in private markets. Private real estate appraisals are slowly adjusting to the shifting economic tides. The second quarter may bring further price declines, particularly office and retail properties where excess capacity makes it highly unlikely landlords can raise rents to offset declining income growth and rising vacancies. Publicly traded real estate investment trusts (REITs), on the other hand, have re-priced significantly and now trade at cheaper levels relative to their fundamentals.

- A slowing economy creates an opportunity for infrastructure assets paying consistent dividends. Economic uncertainty and slowing inflation in 2023 may lead investors to prefer investments with consistent and growing cash flows, such as global infrastructure. Midstream energy stocks should continue to produce outsized earnings growth, even as it decelerates. Utilities are also producing strong and stable earnings growth and should continue to benefit if interest rates decline.

- Slowing growth and inflation are bearish for commodities, though monetary policy is a key influential factor. A slowing economy reduces demand for commodities, and the potential for recession will continue to pressure commodity prices. Precious metals may be an exception, driven by Russia/Ukraine conflict outcomes. A Fed pivot to pursuing expansionary policy would quickly change the environment for commodities, considering limited investments in numerous commodities’ productive capacity over the last several years.

Alternative investments

Quick take: Hedge fund managers are finding good opportunities in 2023, with higher interest rates leading to increased market volatility, creating significant stock price movements. The current economic uncertainty may favor defensive positioning with less overall exposure to the equity and credit markets. We expect many hedge fund managers to keep their overall market exposure low, but that stance does not mean managers will avoid risk.

- We are focused on hedge fund strategies offering diversification benefits. Market neutral managers seek to avoid broad market risk by making a similar amount of long and short investments. Active trading funds may also provide lower correlation with broad stock and bond market movements, but even tactically oriented managers skilled in trading can find these choppy markets difficult to navigate. Nimbleness and agility remain critical.

- We remain positive on macro strategies’ forward prospects due to anticipated changes in economic growth rates, interest rate levels and currency values. Our positive view spans discretionary macro strategies, which are based on managers’ outlooks for various asset classes, as well as systematic macro strategies that apply quantitative rules to identify trend persistence or reversal.

- We continue to look for tactical opportunities in fixed income. Higher interest rates may improve long and short investing opportunities amid wider credit spreads (the additional yield investors demand for taking additional risk relative to safer Treasuries) and performance dispersion among individual securities. We also anticipate a greater number of idiosyncratic credit opportunities to surface, including distressed debt, where managers invest in securities of companies otherwise unable to refinance their debt or meet restrictions on existing debt covenants.

Private markets

Quick take: Business fundamentals helped sustain private equity performance, resulting in less downward pressure on private equity investment performance compared to other asset classes. While we anticipate additional downward pressure on privately held company prices, reflecting the continued rise in interest rates, we continue to find compelling opportunities while applying our thematic and opportunistic framework in combination with a deep bottom-up due diligence process.

- After the market downturn in March 2020, private market valuations increased less than public market prices that peaked in 2021, which partially explains the muted price correction in private markets. Other key private equity return drivers have contributed to a more modest correction as well, such as fund manager expertise and control over business operations to increase revenues and profits. Managers with specific expertise in their focal sectors or industries have multiple tools to improve business performance of their portfolio companies.

- Sellers are still anchoring on company values prior to the market correction and holding on to hopes for a bounce back. Buyers are wary of paying too much for those same companies given higher interest rates, fearing more pain could come to the businesses if the economy slows further. Activity so far in 2023 is stabilizing but is still below average deal levels. We expect activity to pick up once interest rates stabilize and the gap between buyers’ and sellers’ price expectations close in the quarters ahead.

- Private market fundraising activity slowed significantly during the first quarter, and we anticipate that trend continuing throughout 2023. Some investors are over-allocated because their private market allocations held up better through 2022 while public market allocations decreased in value. Other investors are just retrenching in the uncertain environment.

This commentary was prepared April 2023 and represents the opinion of U.S. Bank Wealth Management. The views are subject to change at any time based on market or other conditions and are not intended to be a forecast of future events or guarantee of future results and is not intended to provide specific advice or to be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation. The factual information provided has been obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. Any organizations mentioned in this commentary are not affiliated or associated with U.S. Bank or U.S. Bancorp Investments in any way.

Indexes shown are unmanaged and are not available for investment. The S&P 500 Index is an unmanaged, capitalization-weighted index of 500 widely traded stocks that are considered to represent the performance of the stock market in general. The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. The Personal Consumption Expenditures (PCE) Price Index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. The S&P CoreLogic Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate nationally.

Insights from our experts

Developing your investment strategy

Knowing your investment goals and risk tolerance helps us diversify your portfolio with a mix of equities, bonds and real assets.

Understanding tax law changes

January 6, 2023

Learn what new tax law changes included in the Inflation Reduction Act and SECURE Act 2.0 may mean for you.

How we analyze the economy

The economy doesn’t just move in a straight line. Our Health Check assesses its direction and how fast it’s moving.