Key takeaways

After reaching parity with the euro in 2022, the U.S. dollar has weakened modestly in 2023.

The dollar has also lost ground against other currencies.

Changes in the dollar’s value on currency markets can affect results for U.S. investors who put money to work in global capital markets.

In mid-2022, for the first time in two decades, the dollar reached parity with the euro, Europe’s common currency. At that point, the currencies had matching values (parity means one dollar is equal to one euro). While most of the attention is on the relationship between the dollar and euro, it’s notable that the dollar also gained against other major currencies, such as Japan’s yen, the British pound and the Canadian dollar. However, beginning in late 2022 and continuing into 2023, the dollar has weakened compared to most major currencies.1

“Currency movements are a reflection of the global flow of funds,” says Rob Haworth, senior investment strategy director at U.S. Bank. “For much of 2022, more foreign money was flowing into the U.S. rather than the other way around.” According to Haworth, the direction of capital flows helps determine the relative strength of a particular currency.

In the last two months of 2022 and for much of 2023 so far, the dollar lost ground against the euro. When that occurs, things get more expensive for Americans who travel overseas. But from an economic and investment standpoint, the impact is different. You may want to consider the role of currency trends as you position your investment portfolio.

A long, slow recovery for the dollar

The dollar’s climb to parity with the euro was years in the making. As recently as 2008, it took nearly $1.60 to purchase the equivalent of one euro. The dollar recovered from that point, but with a great deal of fluctuation in value along the way.

In 2015, the two currencies came close to parity, as it took $1.06 to purchase one euro (€). But from that point, the dollar weakened again. At the end of May 2021, the dollar stood at $1.22 to €1. It improved, to $1.14 at the end of 2021, eventually reaching parity in mid-July.2

Haworth says the interest rate environment is one key to determining currency movements. He points out that in early 2022, “Thanks to the Federal Reserve’s (Fed’s) decision to raise the federal funds rate quickly, bond yields in general moved higher in the U.S. than in Europe, and even more so when considering inflation.” More attractive real yields (government bond yields less the rate of local inflation) tended to draw more foreign investment dollars, improving the demand for dollars and driving its value higher.

Haworth says the economic outlook was an additional contributing factor, as for much of 2022, recession risks in Europe appeared to be more pronounced when compared to the same risks in the U.S. However, the environment changed in the closing months of 2022. At that point, it appeared that the Fed would begin to slow the pace of interest rate increases. At the same time, the European Central Bank (ECB) began to implement more dramatic rate hikes. “The ECB’s more aggressive rate stance is a major factor in migrating trade flows toward Europe and away from the U.S.,” says Haworth. “The euro and other currencies became relatively cheap, which started to attract capital flows.” By mid-April 2023, the dollar stood at approximately $1.10 to the euro, a slight weakening from where it started the year.

Source: WSJ.com

Trends follow across the board

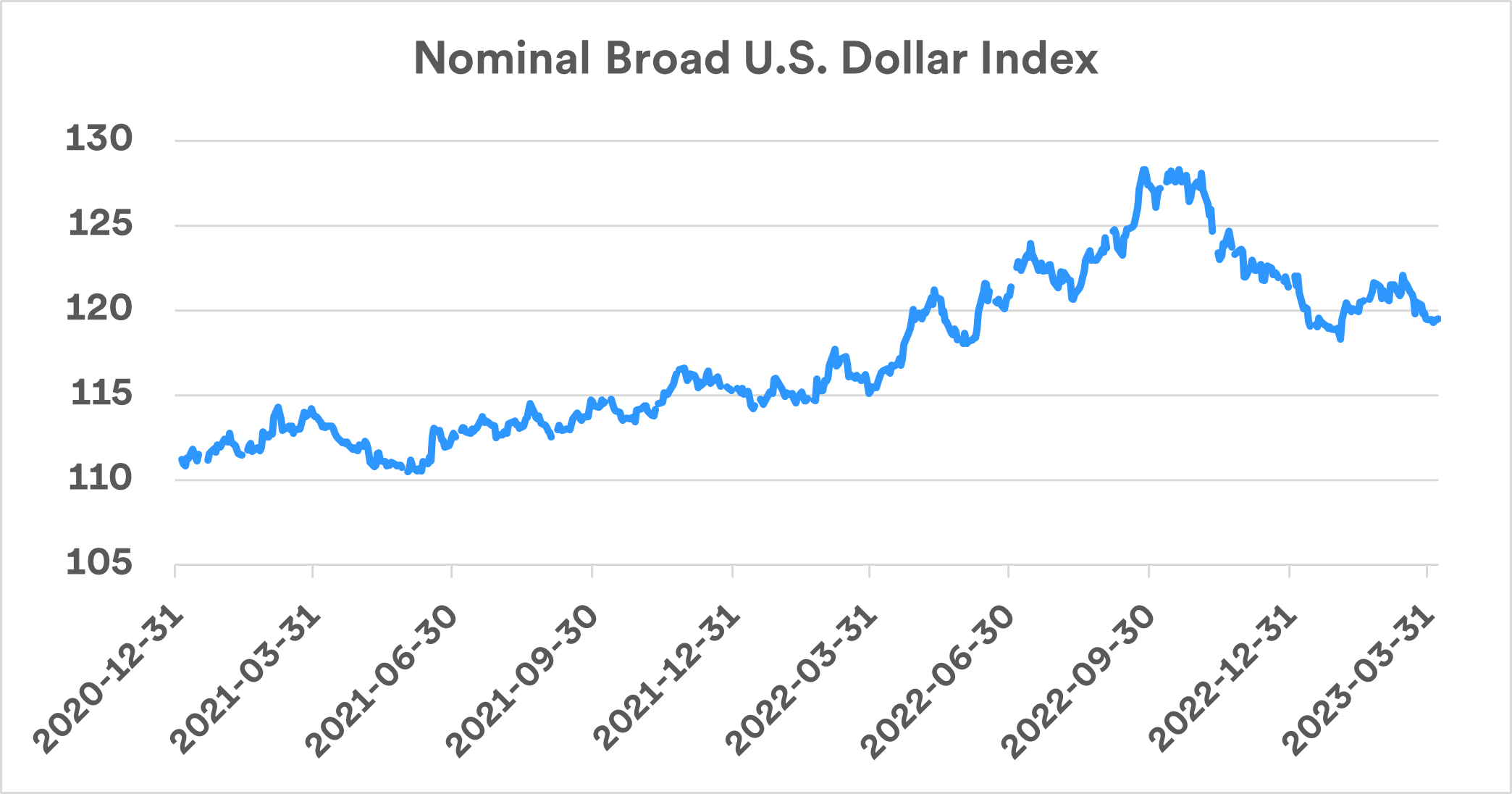

The dollar’s recovery in 2022 was a global phenomenon. This was best exemplified in the Nominal Broad U.S. Dollar Index. This index, created by the Fed, tracks the dollar’s position on a worldwide basis. It measures the U.S. currency’s value relative to a basket of other currencies, based on their relative importance to U.S. import and export activity.

In late September 2022, the index reached a recent all-time high of 128.58, reflecting significant U.S. dollar strength versus other currencies across the globe. This represented a major jump from the end of 2021, when the index value was 115.40 (signaling a weaker dollar). The index was last below 100 (indicating a significantly weaker dollar on a global scale) in December 2014.3

“Some of the improvement we’ve seen in global stock performance in recent months is not just about currency trends. It’s also been because earnings and earnings expectations for foreign stocks exceeded those of U.S. companies.”

Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management

It should be noted that currencies fluctuate constantly. Changes don’t tend to be dramatic on a day-to-day basis, but trends develop over time. Based on the Nominal Broad U.S. Dollar Index, a general trend favoring the dollar began in 2021 and continued until early November 2022. By early April, 2023, the index stood at approximately 119, a modest drop from its peak.

Source: Board of Governors of the Federal Reserve System, as reported by the Federal Reserve Bank of St. Louis.

The economic impact of currency fluctuations

A positive feature of a stronger dollar is the lower cost of imported products from other countries. For example, if a car made in Germany is valued at €50,000 and then is imported to the U.S. when the dollar stands at $1.20 to €1, the retail price of the car in the U.S. would (theoretically) be $60,000 (20% more than its European price to reflect the currency exchange rate). If the dollar were to appreciate to $0.90 to €1, the car’s value in the U.S., using the same assumptions, would decline to $45,000, a significant savings for a U.S. consumer.

However, a strong dollar can also detract from revenues generated by multinational companies based in the U.S. The net income earned from foreign sales will decrease once exchanged into dollars. A stronger dollar means U.S. companies that export products abroad will be less competitive because the price of the product translated into euros or another currency is higher, which can lead to lower sales as foreign buyers shift to lower cost alternatives.

Haworth says that although the euro has bounced back against the dollar in recent months, the recession risk in Europe is still greater when compared to that of the U.S. “A big question will be how Europe manages its energy demands in light of the Russia-Ukraine war and supply interruptions that followed. If energy prices are driven higher over the course of the year, that could heighten the recession risk for Europe.”

Investment implications of dollar trends

Corporate earnings can be affected by currency trends. Yet Haworth says the impact of currency movements shouldn’t be a major consideration for investors as they assess the value of specific stocks. The same is not true, however, for U.S. investors who include overseas-based investments in their portfolios.

For example, consider the value of an investment in the MSCI European Union (EU) Index. In 2022, the index, in local currency terms, suffered a decline of 14.13%. However, the net return for a U.S.-based investor in the fund, translated back into dollars, was -19.97%. In other words, the strong dollar detracted from the return, resulting in an even larger loss during what was an already challenging environment for equities. When the dollar weakens compared to the euro, the net return for U.S. investors is enhanced after the currency exchange. This can again be demonstrated using the MSCI EU Index for the three-month period ending March 31, 2023. In local currency terms, the index returned 7.49%. But after accounting for the currency exchange, the net return for U.S. investors improved modestly to 8.47%.4

“Currencies are less volatile than stocks as whole, and their direction is challenging to predict, given numerous factors that influence relative currency values,” says Haworth. “Based on events since November 2022, currency markets offer a modest tailwind for U.S. investors putting money to work in overseas markets.” While Haworth believes it’s important for investors to be aware of how currency trends may impact investment returns, he warns not to base “buy-and-sell” decisions on those trends. “Some of the improvement we’ve seen in global stock performance in recent months is not just about currency trends,” according to Haworth. “It’s also been because earnings and earnings expectations for foreign stocks exceeded those of U.S. companies.”

Future value of the dollar

How much will the euro and other currencies rebound against the dollar? Haworth notes that currency trends are most prominently driven by relative inflation considerations between the U.S. and the locale of another currency, as well as comparative central bank policies.

For most of 2022, the Fed was far more aggressive than the ECB in raising short-term interest rates. As a result, U.S. fixed income investments pay more attractive yields than those offered by European markets. This pushed more investors into U.S. Treasuries, boosting demand for the dollar. Now the situation has changed, according to Haworth. “The Fed appears to be close to reaching a peak in this interest rate cycle, while the ECB still likely has more work to do and the Bank of Japan has yet to begin raising interest rates.” That could be an indication of potential weakness for the dollar going forward, though other factors may also come into play.

Recent experience exemplifies how currency markets fluctuate, and as Haworth emphasizes, in unpredictable ways. Given the sometimes-arbitrary nature of currency movements, it is unlikely to play a decisive role in your investment strategy. However, the issue may be worth discussing with your wealth management professional, particularly if your portfolio includes overseas investments. It can be beneficial to account for the ways currency trends could impact your investments and potentially influence how you choose to allocate assets within in your portfolio in support of your investing strategy.

Tags:

Related articles

Treasury yields invert as investors weigh risk of recession

What does an inverted yield curve say about the economy’s prospects for a recession?

How do rising interest rates affect the stock market?

With interest rates going up this year, learn what the likely ripple effect across capital markets may mean for investor portfolios.