Private equity and closed-end funds are growing in popularity and presenting new benefits and opportunities for investors.

Whether your private equity firm is a multibillion-dollar shop or a boutique firm managing hundreds of millions in niche assets, there’s a good chance it’s in growth mode.

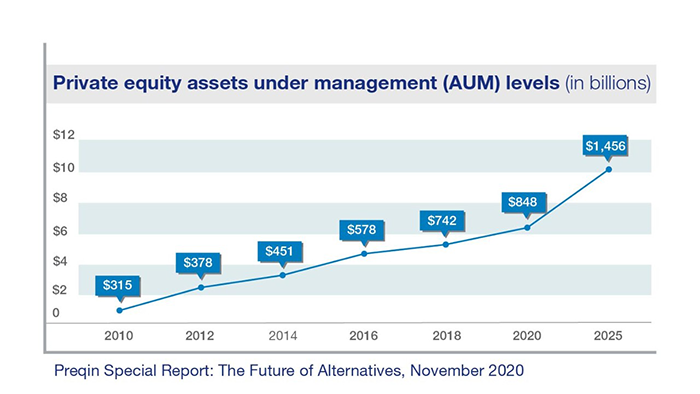

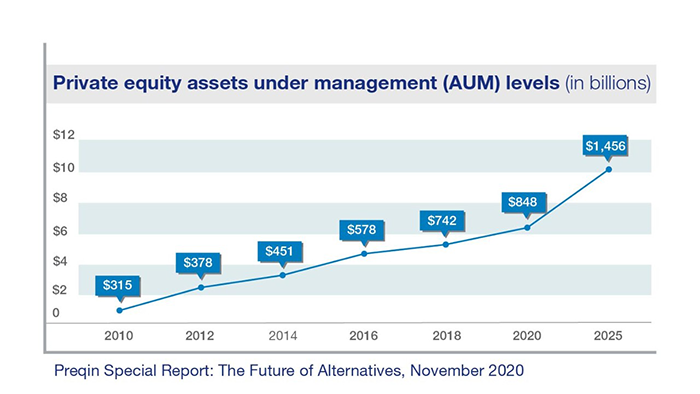

Over the last 10 years, private equity assets have seen substantial growth – rising from $3.15 trillion in 2010 to $8.48 trillion in 2020, according to the private equity data resource Preqin Ltd. And this growth is not expected to slow down. Assets under management in the PE space are expected to grow to $145.6 trillion by 2025.

Closed-end funds

At the center of the surging private equity industry sit closed-end funds – a portfolio of pooled assets that allows private equity investors to target investments in unique market opportunities. Closed-end funds, which raise a fixed amount of capital during a commitment period, are often treated as alternative investments and are defined by targeted investment strategies, GP and LP profit-sharing arrangements. What differentiates them as a closed-end fund is their unique carry interest and waterfall calculations for realized profit and loss events.

According to Peter Mastriano, Global Fund Services senior vice president at U.S. Bank, private equity investments and their related structures have a longstanding preference by limited partner investors. The compensation to the general partner occurs only after the limited partner receives their return of capital and a preferred rate of return on invested capital. This feature of closed-end funds fit particularly well with investment strategies of today.

“Private equity is one of the oldest forms of raising capital in the U.S.,” Mastriano says. “Investment strategies that are prevalent in the capital markets today lend themselves to closed-end funds, which offers tax benefits, attractive fees and a structure sought by institutional investors. It allows access to varied asset classes that may otherwise not be available to investors.”

Tax, fee and structure advantages for the private equity investor

Given the heightened sophistication of the typical private equity investor, tax matters are paramount, Mastriano says. Closed-end funds have several benefits to consider:

Pass-through vehicle: CClosed-end funds serve as pass-through vehicles to limited partners, offering distinct tax advantages. The character of income is preserved in these structures and current tax law provides benefits for the recognition of such gains. This information is provided to limited partners through data points captured within each fund’s annual K-1 form such as:

- Return of capital

- Capital activity recognition

- Long-term interest/dividends/gains earned on capital

- Short-term interest/dividends/gains earned on capital

“These tax treatments can be very beneficial to an individual,” Mastriano says.

Enticing fee structure: Similarly, the fee structure on a closed-end fund can be friendlier to investors than the typical hedge fund assessment. In most closed-end funds, Mastriano explains, the manager’s compensation is driven primarily by transactions that generate liquidity for the fund, such as the acquisition and subsequent disposition of an illiquid holding. “For an investment manager, the fee structure aligns to the investor’s concerns because they aren’t collecting an incentive fee or carried interest on unrealized profits and losses,” Mastriano says.