7 diversification strategies for your investment portfolio

How do interest rates affect investments?

Effects of inflation on investments

It may seem like a small factor, but inflation can chip away at your investments.

Most people understand that inflation increases the price of their groceries or decreases the value of the dollar in their wallet. In reality, though, inflation affects all areas of the economy — and over time, it can take a bite out of your investment returns.

Inflation is a rise in the average cost of goods and services over time. It’s measured by the Bureau of Labor Statistics, which compiles data to determine the Consumer Price Index (CPI). The CPI tracks the cost of goods such as gasoline, food, clothing and automobiles over time to gauge the overall change in the price of consumer goods and services.

In 2021, the cost of living as measured by the CPI rose 7%.1 That means overall prices increased by 7% for the year. Over the 12-month period ending in June 2022, living costs as measured by CPI rose by 9.1%. As an example, this means a car that cost $20,000 in 2020 would now cost around $21,720.

Supply and demand play an important role in inflation. Prices tend to rise when demand for a good or service rises or supply for that same good or service falls. Many factors affect supply and demand nationally and internationally, including costs of goods and labor, taxes on income and goods, and availability of loans.

“We’re still seeing issues in the supply chain of many goods as a result of pandemic-related economic shutdowns,” says Rob Haworth, investment strategy director at U.S. Bank. “This has led to imbalances and higher price levels. For example, the supply of new cars has dropped significantly over the past year due to a shortage of microchips. In turn, we’re seeing demand for used cars go up. These factors have pushed prices higher for both new and used cars.”

Read a more detailed analysis from U.S. Bank investment strategists on the current economic environment’s impact on inflation.

There are three primary drivers that can contribute to a rise in inflation, often referred to as “reflation.”

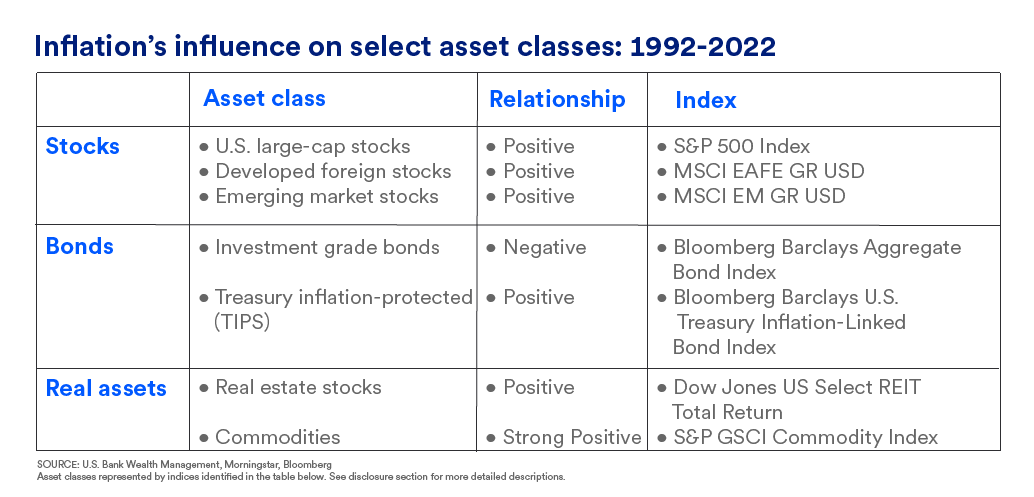

“Rising inflation will influence future returns across asset classes. Investors should consider the potential impact on their investment strategies,” says Haworth.

Assets with fixed, long-term cash flows tend to perform poorly when inflation is rising, since the purchasing power of those future cash flows falls over time. Conversely, commodities and assets with adjustable cash flows (e.g., property rental income) tend to perform better with rising inflation.

Typically, investors buy fixed income securities such as corporate or municipal bonds, treasuries and CDs because they want a stable income stream in the form of interest payments. However, since the rate of interest remains the same on most fixed income securities until maturity, the purchasing power of the interest payments declines as inflation rises. As a result, bond prices tend to fall when inflation is increasing.

One explanation is that most bonds make fixed interest, or coupon payments. Rising inflation erodes the purchasing power of a bond’s future (fixed) coupon income, reducing the present value of its future fixed cash flows. Accelerating inflation is even more detrimental to longer-term bonds, given the cumulative impact of lower purchasing power for cash flows received far in the future.

According to Haworth, “Riskier high yield bonds typically provide higher incomes, and therefore have a larger cushion than their investment grade counterparts when inflation is rising.”

According to analysis performed by the U.S. Bank Asset Management Group, stocks have held up well against inflation over the last 30 years.2 In theory, a company’s revenues and earnings should increase at a similar pace as inflation. This means the price of your stock should rise along with the general prices of consumer and producer goods.

In the past 30 years, U.S. stocks have tended to rise in price somewhat when inflation is accelerating, though the relationship is not particularly strong.

Larger companies tend to have a stronger relationship with inflation than mid-sized companies, and mid-sized companies have had a stronger relationship than smaller companies. Foreign stocks in developed markets tended to fall in price when inflation was rising, and emerging market stocks displayed an even stronger negative relationship.

“Larger U.S. company stocks may provide some benefit in modestly rising inflation environments,” Haworth notes. “However, they are not the most effective investment tool in more robust inflation environments.”

Real assets, such as commodities and real estate, tend to have a positive relationship with inflation, according to analysis performed by the U.S. Bank Asset Management Group.

Commodities have historically been a reliable way to position for rising inflation. Inflation is measured by tracking the price of goods and services which often contain commodities directly, as well as products closely related to commodities. Energy-related commodities like oil have a particularly strong relationship with inflation (see above). Industrial and precious metals also tend to rise when inflation is accelerating.

“Commodities have important drawbacks, however,” says Haworth. “They tend to be more volatile than other asset classes, do not produce any income, and have historically underperformed stocks and bonds over longer time periods.”

When it comes to real estate, property owners can often increase rent payments when prices of goods and services are rising, which can flow through to profits and investor distributions.

Inflation can have a significant impact on your portfolio over time. Alongside working with a financial professional, consider two steps that may help protect your investments against inflation:

Inflation might be beyond your control, but that doesn’t mean you can’t take actions to help preserve your investments and savings from its effects.

Along with inflation, interest rates also have an impact on stocks, bonds and real assets. Read how interest rates affect investments.

Related content