How to take advantage of compounding

The single biggest way to benefit from compounding is to start investing as early as possible. If you want to retire with a certain amount of money, the earlier you start, the less you would have to invest initially. You may even be able to set aside less as you age and put more money toward other goals. The longer your investments have to compound, the greater the impact.

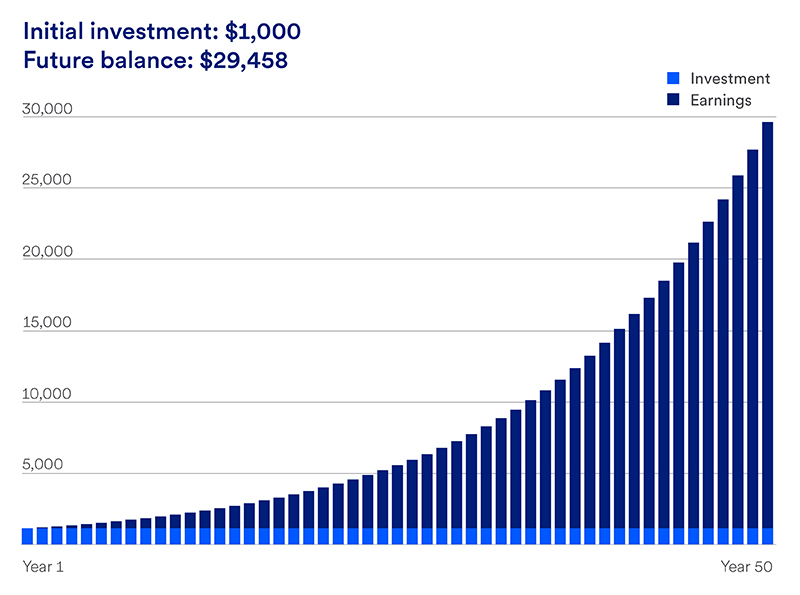

Here’s another illustration (again using a yearly return of 7% as an example – see graphic below): Imagine you’re planning to retire at 70. If you invested your first $1,000 at age 40 and held it for 30 years, you’d have just over $7,613. If you had started at age 20, you’d have more than $29,458 at age 70 — even if you never added another penny .

If you were starting at age 40 and wanted that same $29,000 in retirement (assuming the same rate of return) you’d have to invest roughly $3,900 to start.