Key takeaways

Earnings on bonds can often fail to keep pace with inflation.

Treasury Inflation-Protected Securities, or TIPS, can offer an opportunity to invest in a fixed-income investment that keeps pace with living costs.

Keep in mind that TIPS may not perform as you expect if both inflation and interest rates are high.

Inflation can be the “enemy” of bondholders. In many situations, earnings on bonds can fail to keep pace with the rising cost of living.

Consider a traditional bond that pays 3% while inflation is only 1%. Your purchasing power grows since your return is greater than inflation. However, if inflation is 4% during the life of the bond, despite having a positive return, your bond has not kept up with inflation and your purchasing power falls.

“TIPS tend to perform best in periods when the interest rate environment is relatively stable but inflation is suddenly moving higher.”

Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management.

That’s where Treasury Inflation-Protected Securities, or TIPS, come in. TIPS are issued by the U.S. government and, like other Treasury securities you may add to a portfolio, are backed by the full faith and credit of the federal government.

Unlike regular Treasuries, TIPS provide the potential to earn a total return that reflects the impact of inflation. “For a long-term investor, TIPS can offer an opportunity for an investment that keeps pace with living costs,” says Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management.

Yet TIPS are still subject to price changes created by the underlying investment environment. “When interest rates are rising, prices of TIPS are subject to a loss in value just as is the case with other types of bonds,” says Haworth. “The impact of inflation is still reflected in the price of TIPS, but they’re also subject to changes in the broader interest rate environment.”

How TIPS work

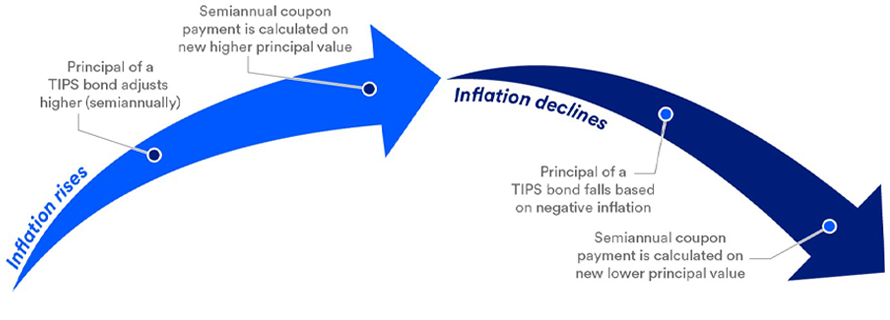

The primary way TIPS account for inflation is by adjusting the principal value of the securities in line with the inflation rate as reflected in the Consumer Price Index (CPI), which is published by the Bureau of Labor Statistics. When the cost-of-living as measured by CPI increases, the principal value of a TIPS security rises to reflect that change. If deflation occurs and CPI declines in value, the principal value of TIPS declines as well.

SOURCE: U.S. Bank Asset Management Group. For illustrative purposes only and not based on specific historical outcomes.

As an example, say you own TIPS valued at $10,000 with a coupon of 5%. Based on the initial principal value, that would result in income of $500 for the year (TIPS pay interest twice a year).

- If the CPI increases by 3%, the principal would adjust by the same percentage, resulting in you receiving 5% of $10,300 for the year, or $515.

- If the CPI declines 4%, the $10,000 principal on your TIPS is readjusted to $9,600, and the 5% coupon gives a return of $480.

Notably, as the principal value adjusts, the dollar value of the interest rate paid by TIPS will adjust in a corresponding manner. The interest rate remains constant, but as principal value fluctuates, the actual interest received in dollar terms will also change. This is different from a typical bond, where the dollar value of the payout is determined based on the applicable interest rate when the bond is initially purchased.

The inflation-adjusted principal value is not realized until the issue matures or is sold. At that time, the investor receives the higher of the adjusted principal value or the original principal value. TIPS Inflation Index Ratios1 are provided by the U.S. Treasury department to help calculate the impact on bonds.

TIPS and taxes

Interest payments from TIPS are subject to federal tax but exempt from state and local taxes. In addition, the amount of increase in principal value is considered taxable income at the federal level, though exempt from state and local taxes.

The increase in principal value generated in a given year results in a “phantom income” effect, because the increases in principal are taxed in the year they occur, even if the gains are not realized.

Opportunities and risks with TIPS

As you consider how TIPS might fit into your portfolio, it can be helpful to weigh the opportunities they provide along with the risks.

Opportunities:

- TIPS offer a unique opportunity for bond investors to achieve a degree of inflation protection not available in most forms of fixed income investments.

- TIPS are backed by the full faith and credit of the U.S. government, and thus have low credit risk.

- Both underlying principal and the income generated can rise in line with the rate of inflation.

- At maturity, the principal value of TIPS will be no lower than your initial investment.

Risks:

- As is the case with traditional bonds, the underlying value of TIPS can decline in times when interest rates are rising.

- In deflationary times, the value of TIPS and income generated from them will decline.

- Appreciation in principal value is taxable even before those gains are realized.

“TIPS tend to perform best in periods when the interest rate environment is relatively stable but inflation is suddenly moving higher,” says Haworth. “In periods like these, the inflation adjustments in TIPS can provide some advantages.” Yet Haworth notes that even in times when inflation is higher, TIPS may not perform as well as an investor might expect if interest rates are also on the rise.

How to invest in TIPS

TIPS are issued at various times throughout the year, are available in 5-year, 10-year and 30-year maturity terms, and are sold in $100 increments. TIPS can be purchased through a bank or brokerage firm, or directly online through the U.S. Treasury website. Certain mutual funds and exchange traded funds (ETFs) may also invest in TIPS.

Work with your financial professional to determine if TIPS are a good fit for your investment portfolio.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Indexes mentioned are unmanaged and are not available for investment.

Tags:

Related articles

How to invest in bonds for portfolio diversification

Bonds are a common investment in times of economic uncertainty, but they also play an important role in diversifying your portfolio.

Financial planning considerations when inflation is high and interest rates are rising

Persistent inflation and rising interest rates can affect your ability to meet your financial goals. Consider a few specific actions to take if you’re looking to help generate income to meet cash flow needs or growth in your portfolio.