Key takeaways

A financial plan designed to help you work toward your goals requires a thoughtful investment strategy.

U.S. Bank uses capital market assumptions (CMAs) to guide expectations on future asset class performance.

CMAs can inform how your portfolio is structured to help you achieve your most important planning objectives.

If you’ve established specific financial goals, such as building your retirement savings or a college fund for children, you need your investments to generate returns to help you achieve those goals. The process usually involves identifying a reasonable target return you seek to earn over time (based on your risk tolerance level) and investing a certain amount of money each year toward your goals. The challenge is to merge your return “target” with a diversified mix of investments that can reasonably be expected to achieve that target.

It’s important to build your investment portfolio on reasonable expectations of what lies ahead. As the common investment saying goes, “past performance is no guarantee of future results.” It’s not generally effective to construct a portfolio based on how investments have performed recently. The future may look very different, and the results generated in your portfolio could differ significantly from the recent past.

“Capital market assumptions provide helpful information to guide investors on how to structure their portfolios to achieve specific goals they’ve identified in the planning process.”

Rob Haworth, senior investment strategy director for U.S. Bank Wealth Management

How specific asset classes perform over the course of your investment time horizon can vary based on a number of factors. It’s important your investment assumptions reflect realistic expectations over multiple future business cycles.

Setting a base of performance expectations

Each year, the Asset Management Group at U.S. Bank Wealth Management contemplates economic and market scenarios for the next business cycle, typically over five-to-seven years. This forms the basis of a set of capital market assumptions (CMAs) across more than 30 asset classes. These assumptions are based not just on historical performance data, but also current considerations of market prices and environments and future expectations for economic and market relationships.

Often investors’ financial goals extend beyond the five-to-seven-year time horizon. The Asset Management Group at U.S. Bank Wealth Management also develops a supplemental set of capital market assumptions for use in financial planning discussions. This extends the typical five-to-seven-year assumptions (what is considered a single business cycle) to a 20-year view, spanning as many as three-to-four business cycles.

Building long-term performance assumptions is a complex process. For the 20-year view, the Asset Management Group narrows the CMA process to a group of 22 asset classes that are considered central to the construction of a long-term, diversified portfolio. No investor would be expected to invest in all 22 asset classes, but the 22 classes are regarded as the most appropriate segments of the investment markets for long-term investors.

“We think about our investment mandate as one that’s focused on deriving performance that helps clients meet their goals,” according to Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. “The primary element for portfolios is generating returns to achieve results.” Haworth believes the asset classes represented in CMAs provide investors with appropriate opportunities to create a broadly-diversified portfolio that’s well positioned to achieve long-term financial objectives.

The challenges inherent in long-term financial planning

The process of building CMAs for the benefit of future planning centers on projections made over the next business cycle. “We view projections around the five-to-seven-year time horizon as being our most accurate,” says Haworth. “The further along the time horizon you go, the fuzzier things get.”

Specifically, the assumed returns laid out in the CMA are subject to a range of possible outcomes. “Actual results could be higher or lower than our estimates,” says Haworth. “But our assumptions are meant to be directionally consistent and correct. It offers guidance so investors can structure a portfolio and plan that works for their financial situation, goals and preferences.”

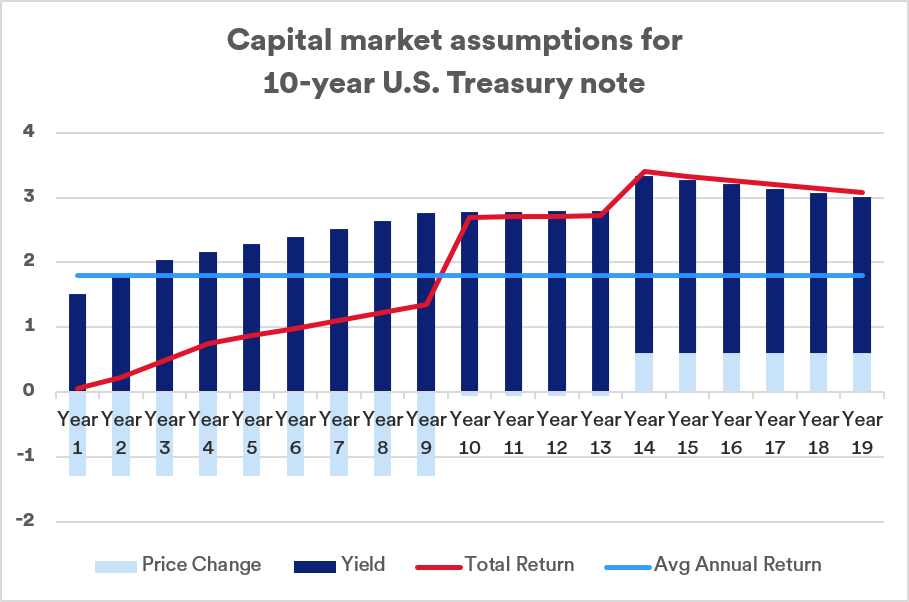

The CMA process assumes that asset relationships normalize over time. For example, consider the case of returns on 10-year U.S. Treasury notes. For the five-to-seven-year cycle, the assumed annual return is -0.04%. This is lower than historical returns for this asset class. The expectation of a reduced return over the five-to-seven-year period is based on the fact that at the outset of 2022, interest rates were near historical lows (the yield on the 10-year Treasury was 1.52% as of Dec. 31, 2021). Looking at the 15 years beyond the initial business cycle, it’s assumed that base interest rates will be higher, returning to more normal levels by historical standards. That means investors will earn higher yields on 10-year Treasuries than was the case in recent years. At the same time, as rates rise, the value of bonds already held declines. From a total return perspective, that negates some of the benefit of investing in bonds with higher yields. Still, over the 20-year period, our CMAs project an annual return for 10-year Treasuries of 1.79%, significantly higher than for the initial five-to-seven-year period.

The illustration above reflects market-forward expectations and normalization of historic relationships, such as real yields, to project the forecasted change in interest rates. Modeled price changes reflect current duration and convexity of the 10-year U.S. Treasury relative to the change in yield from the prior year. Blended with the starting yield in a given year provides the total return for that year. The information in this chart is for illustrative purposes only and is not a guarantee of future results.

Source: U.S. Bank Asset Management Group, July 2022.

This points out the value of using CMAs as a basis for long-term financial planning. “It’s important to think about the price at which you can buy assets today,” says Haworth. “In certain times, you might assume that your portfolio’s cash position could earn 4% annually. The reality today is that you’re likely to earn closer to 1%.” Haworth believes this is a critical consideration for investors. “We want today’s investments to be a reflection of the markets and your financial plan, because you need to buy assets at current market prices.”

CMAs seek to account for current asset values in relation to their historical levels while also anticipating what lies ahead over a longer time horizon.

Trends identified by CMAs

Among the notable trends anticipated in the current assumptions are:

- Investment returns improving over the course of a 20-year time horizon, from low near-term expectations.

- Short-term interest rates reverting to historical average levels from the low-rate environment that’s existed for several years.

- Slightly higher inflation rates, which may provide a beneficial tailwind for investors.

- Low rates of economic growth around the world, which may temper potential returns.

- A starting base of historically high asset class valuations which could revert to normal, historical levels. This includes stock prices that are high as measured by current price levels compared to actual or expected cash flows. It also includes bond yields begin from historically low levels, rising over time, which detracts from bond values.

Keep a proper perspective

It’s not possible to predict the future direction of the markets over the short term. However, historic performance of various asset classes and how they tend to respond in different economic environments can help inform long-term projections. Capital market assumptions from the Asset Management Group at U.S. Bank Wealth Management offer guidance to investors focused on structuring long-term portfolios to meet specific investment objectives.

“An individual investor’s financial plan and the implementation of an investment strategy are joined,” says Haworth. “CMAs provide information to help guide investors on how to structure their portfolios to achieve specific goals they’ve identified in the financial planning process.”

Talk to a financial professional for more information on how to make use of this guidance from U.S. Bank.

Tags:

Related articles

How to handle market volatility

Understanding the why behind market volatility can help you manage your risk. Here are five market strategies on how to handle market volatility.

2023 investment outlook: A tale of two halves

While the U.S. economy will likely struggle at the outset of 2023 due to higher interest rates, slowing inflation by the second half of the year could help support economic recovery and a more favorable investment environment.