Key takeaways

Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation.

Active investing relies on real-time market pricing; investors sell their shares when stock prices are high and buy new shares when prices are low.

A passive investing strategy requires patience and selectivity and can outperform active investing over time.

As long as markets have existed, many investors have tried to maximize gains and minimize losses by timing the market.

In theory, investors believe they should buy when prices are low but rising and sell when prices are high but falling. However, when it comes to stock market timing, you must successful twice: Once when you buy and then again when you sell. Getting the timing right on both ends is doubly difficult. Plus, every time you trade, you incur brokerage fees and taxes, which can quickly reduce any additional returns you’ve gained on both the purchase and the sale.

Instead of trying to time the market, consider spending time in the market. You may find that a passive investment strategy, such as buy-and-hold, can help you gain long-term returns.

What is passive investing?

The overall goal of passive investing is to build wealth gradually. Also referred to as a “buy-and-hold strategy,” passive investors focus on a long-term plan and don’t profit from market timing or short-term market fluctuations.

What is active investing?

Active investing involves real-time buying and selling and is intended to build wealth quickly. An active investor, or portfolio manager, constantly monitors the stock market and trades shares when the opportunity arises.

What is a buy-and-hold investment strategy?

The buy-and-hold strategy is a popular long-term investment where you buy stocks and other securities and hold on to them regardless of changes in the stock market.

The following points help explain stock market investments and why buy-and-hold investing may be worth implementing:

1. Investments can grow despite market fluctuations

The U.S. stock market volatility can be intimidating — and while past performance is not a guarantee of future returns — history shows the market has been able to recover from declines and still provide investors with a positive return on long-term investments. In fact, over the past 35 years, the market has posted a positive annual return in nearly eight out of every 10 years.1

2. When to invest in stocks

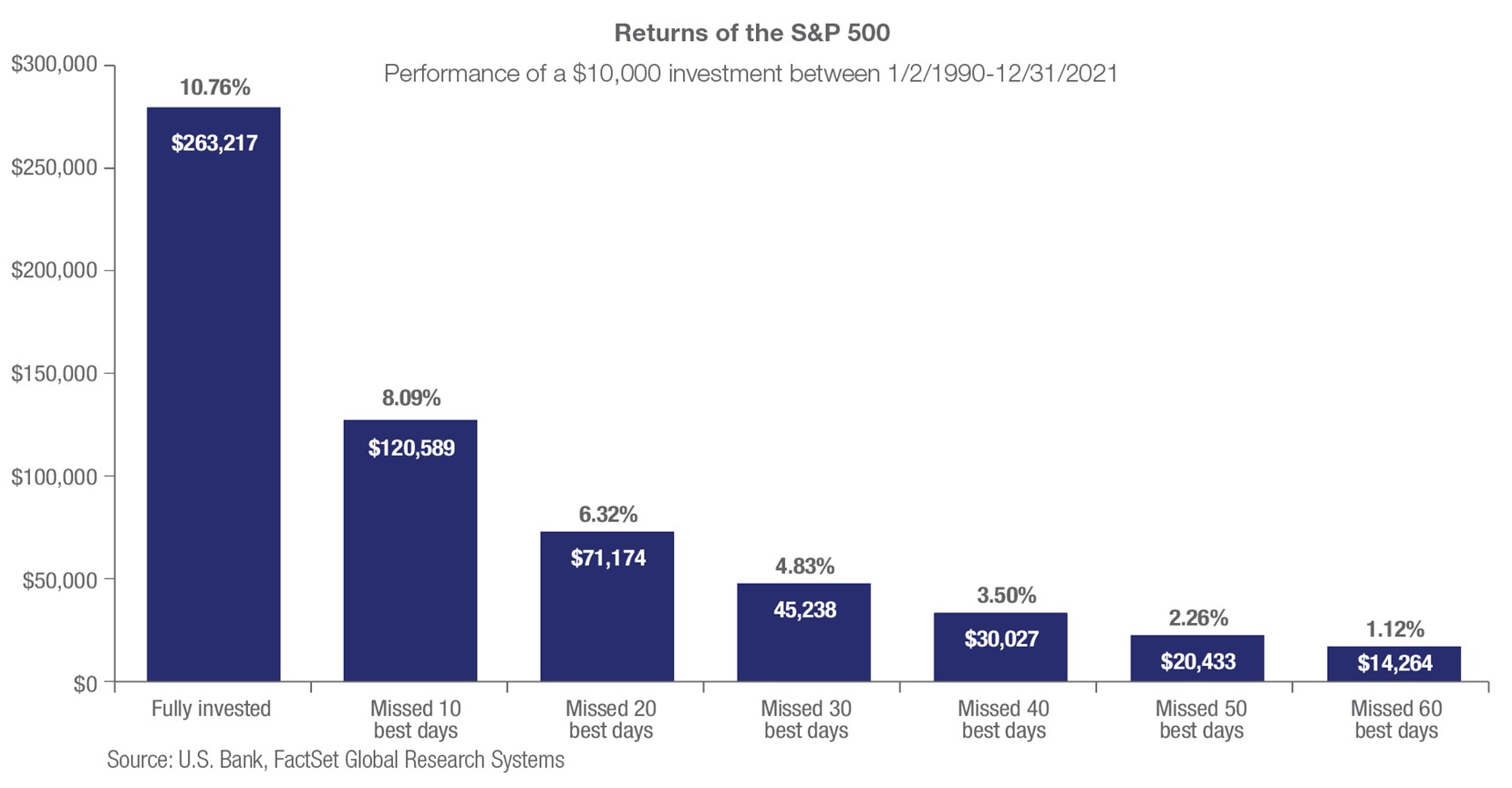

A buy-and-hold strategy can help investors avoid missing out on the market’s biggest days.

The hardest part about choosing when to be in or out of the market is that missing a few key days or weeks of a five- or ten-year cycle can have a significant influence on your returns. Historically, a large share of the stock market’s gains and losses occur in just a few days of any given year. Since the pattern of returns isn’t predictable from month to month, a consistent long-term investment can add to your bottom line.

3. Potential to recoup losses faster

For most investors, a buy-and-hold strategy can result in quicker loss recuperation, even after a bear market when a major index like the S&P 500 falls by more than 20% from its recent high.

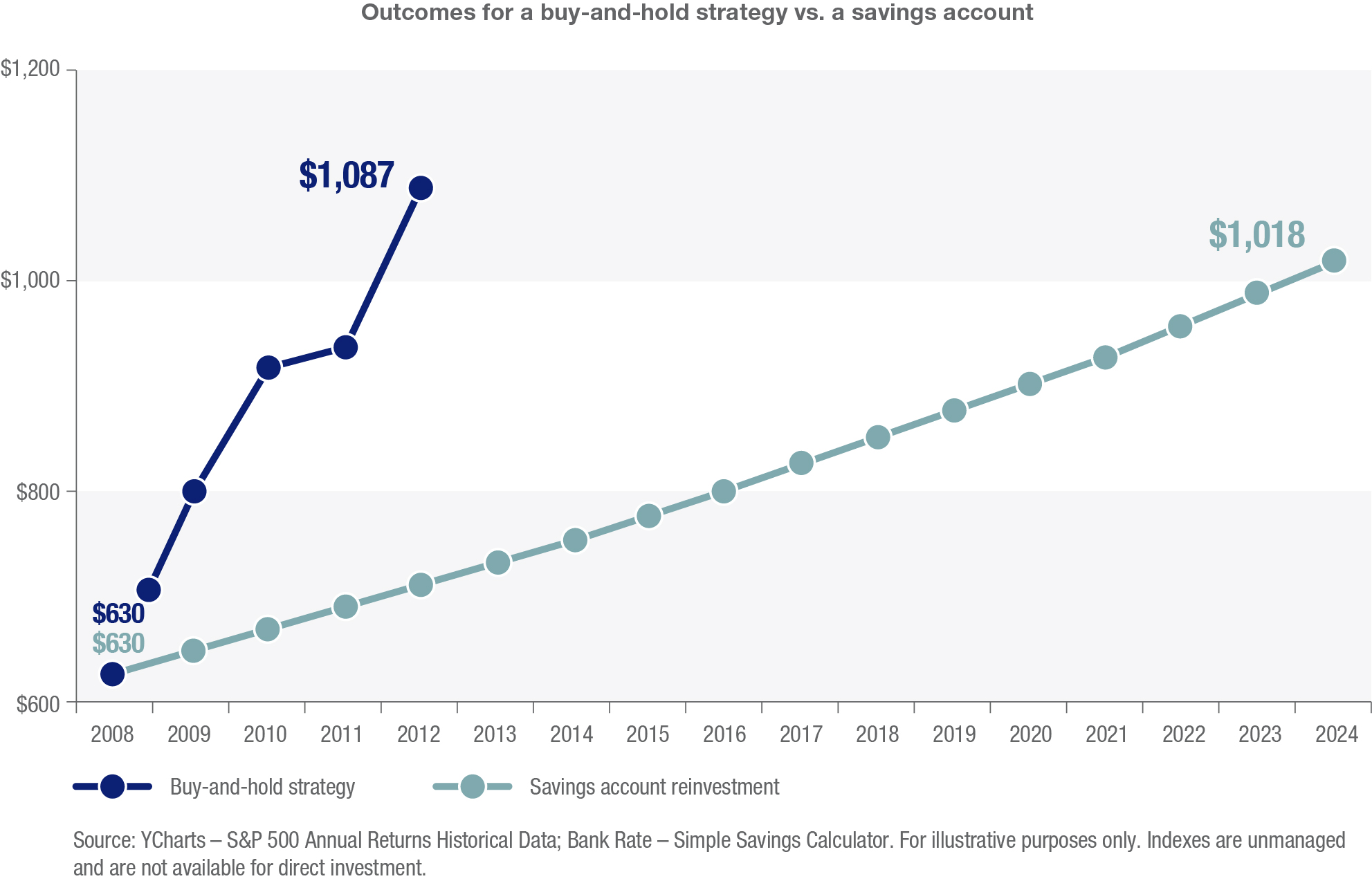

As an example, let’s say you invested $1,000 in the S&P 500 on January 1, 2008. That year, the S&P 500 lost 37% of its value.2 At the end of 2008, your investment was worth $630. Consider the differing outcomes depending on whether you used a buy-and-hold strategy or chose to reinvest $630 into a savings account with a 3% interest rate, compounded monthly.

Using a buy-and-hold strategy, you would have recouped your losses by 2012, even without making additions to your original stock market investment. With your funds in the savings account, in this example, it would take 16 years to recoup your losses and cross the $1,000 threshold.

4. Grow with compound interest

A buy-and-hold strategy can also help investors take advantage of compound interest. While past performance is not a guarantee of future returns, the S&P 500’s inflation-adjusted annual average return on investment is about 7%.3 This means, on average, the index’s value is 7% higher at the end of the year than it was at the beginning. These gains accumulate over time and can provide an advantage to those who start long-term investing early.

5. An early start vs. stock market timing

Investors often try to wait for the “right” time to start putting money into the stock market. But the longer they delay their investing, the longer they miss out on company dividends.

Don’t underestimate dividends. These individual payouts might seem small, especially when you’ve been investing for only a few years, but more than 40% of gains in the S&P 500 have come from dividends.2

As a stock market investor, you can choose to cash in your dividends as soon as they’re available, or you can opt to reinvest your dividends back into the market, manually or automatically.

Automatic dividend reinvestment expands your portfolio with minimal effort on your part. As you reinvest your dividend payouts, you’ll purchase additional shares that earn additional dividends. In other words, dividend reinvestment can help you leverage the magic of compound returns. Accumulating dividends can add significant value to your portfolio.

Still, it’s important to understand two potential downsides to automatic dividend reinvestment.

- The dividends you receive from Company A are automatically reinvested to purchase more shares of Company A. This takes away your option to reinvest dividend payouts from Company A into Company B, even if Company B is more attractive and would accelerate your portfolio’s growth.

- If you automatically reinvest dividends, you still need to account for taxes. When you receive a dividend payment, that amount of the dividend is taxable income, even if the dividends were reinvested into the same stock automatically.

If your investing strategies aim for retirement, you might want to turn off dividend reinvestment once you’ve stopped working. That way, you’ll receive cash distributions that you can put toward living expenses. Before retirement, however, reinvesting dividends can help maximize your gains and set you up for the potential to receive higher payouts in the future.

6. How to buy a stock and hold it

There are generally two buy-and-hold investing options. You can choose to buy your investments all at once (lump sum investing) or begin an investment schedule (dollar cost averaging).

- Lump sum investing is precisely that: A large chunk of money. If you have a lump sum to invest, you can do so all at once. A lump sum approach requires you to have a larger sum of money to invest. You may receive a lump sum of cash through the sale of a family business, sale of company stock, inheritance, proceeds from an insurance policy, or by other means.

The sooner you invest your sum of money, the sooner you begin earning returns, especially, in this case, compound returns.

- Dollar cost averaging is the practice of contributing a fixed dollar amount to an investment on a regular schedule. It allows you to enter the market even if you have only a small amount to invest each month.

As an example, let’s say you invest $300 per month for one year in an index fund that covers a broad range of stocks. When values — the prices you pay for your shares — are higher, your $300 contribution will buy fewer shares. When values are lower, your contribution will purchase more shares. Over the course of a year, you’ll most likely pay an average price for the investment overall. Therefore, you’ve reduced the risk of repeatedly buying at peak values.

With this approach, you can start investing early and take advantage of compound returns. It’s important to note that dollar cost averaging does not guarantee you’ll pay less for your investments compared with a one-time buy. But investing on a regular schedule helps develop a habit of putting money away.

Oftentimes, emotions can sabotage a buy-and-hold, long-term investment strategy. Overconfidence might lead you to trade too frequently while fear of loss might cause you to hang on to investments that no longer support your goals or earn a sustainable return. However, when you invest more regularly and focus on the long-term, you can feel confident that you’re steadily working toward your goals.

Learn how we approach your long-term investing success.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. Dollar Cost Averaging does not assure a profit and does not protect against loss in declining markets. Such a plan involves continuous investment in securities regardless of fluctuating price levels and investors should consider their ability to continue purchases through periods of fluctuating price levels.

Tags:

Related articles

Strategies for coping with market volatility

Following your emotions too closely may point your investments in the wrong direction.

How far will the market correction go?

With stocks slipping in and out of market correction territory, how might ongoing volatility impact your investments?