Key takeaways

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 revised existing rules around retirement saving, including raising the age of required minimum distributions (RMDs) and eliminating age limits for traditional IRA contributions.

Congress has now passed a follow-up package, the SECURE 2.0 Act, which alters rules that affect your retirement savings.

The new provisions could impact how you save in and withdraw money from your retirement accounts.

SECURE 2.0 Act was signed into law in late 2022, delivering dozens of new retirement-related provisions. These changes build on the original SECURE Act of 2019, which altered the rules around how you can save and withdraw money from your retirement accounts. SECURE 2.0 Act addresses additional issues related to retirement and savings that were not part of the original SECURE Act, creating new flexibility and accessibility to help individuals plan for a more secure future.

“Secure 2.0 Act offers comprehensive changes to address the retirement savings gap for individuals,” says Sarah Darr, head of financial planning at U.S. Bank Wealth Management. “There are very few people who won’t be affected by these changes.”

“These changes can empower individuals to reach savings goals and provide more flexibility upon retirement.”

Sarah Darr, head of financial planning at U.S. Bank Wealth Management

The lack of retirement preparedness among Americans has drawn the attention of Washington policymakers. According to one study, by 2050, the U.S. will face a $137 trillion retirement income gap (the difference between what savers should have and what they’ve actually saved). If projections hold, retirees in six major economies (including the U.S.) would outlive their savings by an average of eight to 20 years.1 “These new changes can empower individuals to reach savings goals and provide more flexibility upon retirement,” says Darr.

Key retirement provisions of the new SECURE 2.0 Act

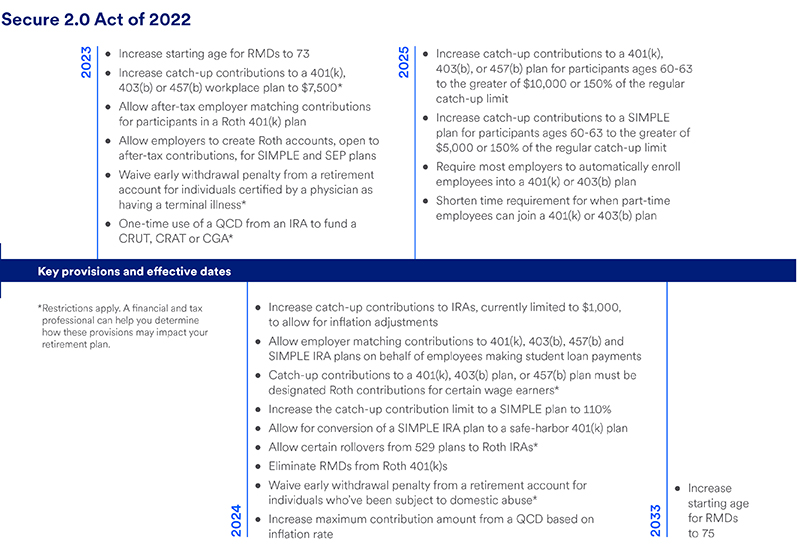

The new legislation, passed by Congress and signed into law by President Biden in December 2022, may have an immediate impact on your retirement savings and income strategy. Note that the effective dates of the new provisions vary. Some are effective immediately in 2023, others will begin over the next few years. The effective dates are highlighted with each provision outlined below. Here are some of the most important changes:

Raising the starting age for RMDs

Effective Jan. 1, 2023, the threshold age that determines when individuals must begin taking required minimum distributions (RMDs) from traditional IRAs and workplace retirement plans increases from 72 to 73. As a result, individuals now can choose to delay taking their first RMD until April 1 of the year following the year in which they reach age 73. From that point on, RMDs must be received each year by December 31.

On Jan. 1, 2033, the threshold age for RMDs will rise to 75. In addition, the penalty for failing to take RMDs on a timely basis is cut in half effective in 2023, from 50% of the undistributed amount to 25%. “Extending RMD dates provides individuals more flexibility for dollars to grow tax deferred,” says Darr. "Decreasing the RMD penalty makes it more reasonable should mistakes occur.”

If individuals take advantage of delayed RMDs, the amount of withdrawals required in later years will be larger, which will result in a potentially higher tax liability in those years. “Taking some distributions prior to age 73 will help mitigate tax concerns later on,” says Darr. “In addition, individuals should seek to create a more tax-diversified portfolio.” This could include Roth IRAs and non-qualified holdings that have generated significant, unrealized capital gains that have more favorable tax treatment. “Preserving assets with beneficial tax treatment to generate income later in life will help manage future tax liability,” adds Darr.

An increase in catch-up contributions

Catch-up contributions allow people age 50 and older to set aside additional dollars over the standard maximum contributions to workplace retirement plans (such as 401(k)s) and IRAs. Under new proposals, another form of “catch-up contribution” would be created for those ages 62 to 64 (under one plan) or 60 to 63 (under another plan). At that point, individuals would be allowed to add $10,000 to a 401(k) or 403(b) plan. This maximum would be indexed for inflation in future years.

The second provision requires all catch-up contributions to be on an after-tax basis, except for individuals who earn $145,000 or less. And beginning in 2024, catch-up contributions to IRAs, currently limited to $1,000 per year, will be adjusted for inflation in increments of $100.

“The ability to put more income to work in a tax-advantaged retirement savings plan not only boosts retirement savings,” says Darr, “but also reduces current taxable income.” As a result, some individuals may be able to avoid moving into a higher tax bracket by deferring a larger chunk of their salary and taking advantage of expanded catch-up contributions.

Auto enrollment in 401(k) plans

Employers currently have an option to initiate “automatic enrollment” of employees into a workplace retirement plan. When this occurs, employees automatically participate in the plan unless they choose not to. Under SECURE 2.0 Act, effective in 2025, the process reverses, and automatic enrollment is required of most major employers.

The amount automatically deferred each year will range from 3% to 10% of an individual’s income. Employees who don’t wish to participate in the plan can choose to opt out. Businesses with 10 or fewer workers and companies in business for less than three years are among those excluded from the mandate.

“Auto enrollment has the potential to be a real game-changer for participation in workplace plans,” says Darr. “As it stands, too few people make contributions to qualified workplace retirement plans. This will encourage people to save more.”

An additional change affecting workplace plans is that, beginning in 2025, part-time employees will qualify to participate in a plan once they’ve worked at least 500 hours for two consecutive years. Under existing law, part-time workers must meet the 500-hour threshold for three consecutive years.

Retirement plan contributions for those with student loan debts

A provision of SECURE 2.0 Act that takes effect beginning in 2024 will allow employers to make contributions to workplace savings plans on behalf of employees who are still repaying student loans. It isn’t unusual for younger workers carrying student debt to forego retirement plan contributions in order to continue to pay off college loans. Under the new law, employers would be allowed to make contributions on behalf of employees faced with this dilemma, even if those employees do not make retirement plan contributions. Employer retirement plan contributions can match the amounts of student loan debt repaid by the individual worker in a given year.

“This creates an excellent opportunity for employers to offer an incentive to attract and retain employees,” says Darr. She notes that it could prove to be an effective way to kick-start a retirement savings plan for younger workers who are burdened with college loans.

Rollovers of 529 Plan balances to Roth IRAs

Under prior law (still in effect in 2023), leftover balances in 529 education savings plans can be taken as a non-qualified distribution, but the earnings portion of the distribution is subject to income tax and a 10% penalty. Beginning in 2024, based on provisions in the new law, you’re allowed to roll up to $35,000 of leftover funds into a Roth IRA.

The $35,000 threshold is a lifetime limit subject to a few restrictions. The 529 account must have been in place for at least 15 years and funds must move directly into a Roth IRA for the same individual who was the beneficiary of the 529 plan. Any 529 plan contributions made in the previous five years, and any earnings attributed to those contributions, are not eligible to be rolled into a Roth IRA. The amount moved into a Roth IRA a given year must be within annual IRA contribution limits.

“This reduces the fear of overfunding a 529 plan by allowing excess funds to be used for other needs without penalty,” says Darr.

Changes to Roth employer plans

Under current law, there are no provisions that accommodate employer matching contributions to employees’ after-tax Roth 401(k) plan contributions. Effective in 2023, individuals can choose to have employer matching contributions directed to their Roth workplace accounts. These contributions will be considered taxable income in the year of the contribution.

Under current law, Roth 401(k)s (unlike Roth IRAs), are subject to RMDs. A provision in the SECURE 2.0 Act eliminates RMD requirements for workplace-based Roth plans beginning in 2024. This change results in Roth 401(k)s having similar treatment related to RMDs as Roth IRAs.

In addition, effective in 2023, employers will be allowed to create Roth accounts, open to after-tax contributions, for SIMPLE and SEP retirement plans. Under previous law, these plans only allowed for pre-tax contributions.

Establishment of a Saver’s Match

The current “Saver’s Credit” program allows those meeting lower income thresholds to claim a tax credit for contributions made to workplace savings plan or IRA. Effective in 2027, the credit is being replaced by a “Saver’s Match.” The match will equal up to 50% of the first $2,000 contributed by an individual to a retirement account each year (or up to $1,000). This will be a federal matching contribution deposited into the saver’s traditional retirement account.

Penalty-free early withdrawals

The current tax code imposes a 10% penalty for distributions taken from a retirement account prior to reaching age 59-1/2. SECURE 2.0 Act expands the circumstances where penalty-free withdrawals could occur.

Exceptions to the 10% penalty include:

- Effective immediately, the penalty for early withdrawals is waived for those certified by a physician as having a terminal illness or condition that can reasonably result in death in 84 months or less. To avoid a penalty, distributions must be repaid within three years.

- Effective Jan. 1, 2024, “hardship” withdrawals are available for individuals who have been subject to domestic abuse equal to the lesser of $10,000 or 50% of the vested balance of the retirement account. The withdrawal must occur within one year after the individual became a victim of abuse. And all or a portion must be repaid within three years.

- Effective in 2026, withdrawals of up to $2,500 per year can be made to pay premiums on certain types of long-term care contracts.

New rules for qualified charitable distributions (QCDs)

Under current law, individuals age 70-1/2 and older can direct up to $100,000 in distributions per year from a traditional IRA to qualified 501(c)(3) charitable organizations. Effective in 2024, a new provision will allow the maximum contribution amount to increase based on the inflation rate.

In addition, beginning in 2023, individuals have a one-time opportunity to use a qualified charitable distribution (QCD) to fund a Charitable Remainder Unit Trust (CRUT), Charitable Remainder Annuity Trust (CRAT) or a Charitable Gift Annuity (CGA). Up to $50,000 (indexed for inflation) can be directed using this one-time distribution option. If a distribution is directed to a CRUT or CRAT, it must be the only form of funding for that trust.

“QCDs are often an overlooked planning opportunity for individuals to manage gifts and reduce taxes,” says Darr. “The updated QCD provisions account for recent inflation relative to an individual’s charitable giving plans.”

New limits for Qualified Longevity Annuity Contracts (QLACs)

Effective immediately, the “25% of account balance” limitation for QLACs is eliminated. In addition, the maximum amount that can be used to purchase such products was raised from $145,000 in 2022 to $200,000 effective in 2023.

Consider the impact on your own retirement plan

As a result of the SECURE 2.0 Act, rules around retirement savings and retirement plan distributions will change over the course of the next few years. “These provisions can be complex, so you may want to connect with a financial professional to understand how it impacts your retirement situation,” suggests Darr. They may be able to identify specific opportunities and/or changes to help you achieve your retirement goals.

As you consider what new opportunities may be most appropriate to enhance your retirement savings in the future, take the time to assess where you stand today. A financial professional can help you review your current strategy and discuss which changes may be most beneficial. You may also wish to consult with your tax advisor to understand the potential tax ramifications of any decisions you make.

Learn how we can help you financially plan for retirement.

Tags:

Related articles

How to put cash you’re keeping on the sidelines back to work in the market

Don’t let market volatility and an uncertain economic outlook derail your disciplined investing strategy.

Retirement planning toolkit

Whether you’re just starting to save, close to retiring or already retired, we’re to help you work toward the retirement you want.