Automated Investor is U.S. Bancorp Investments’ robo-advisor. Like many other robo-advisors, it uses a set of investing rules run by advanced computer software to manage your investments automatically in an investment advisory account.

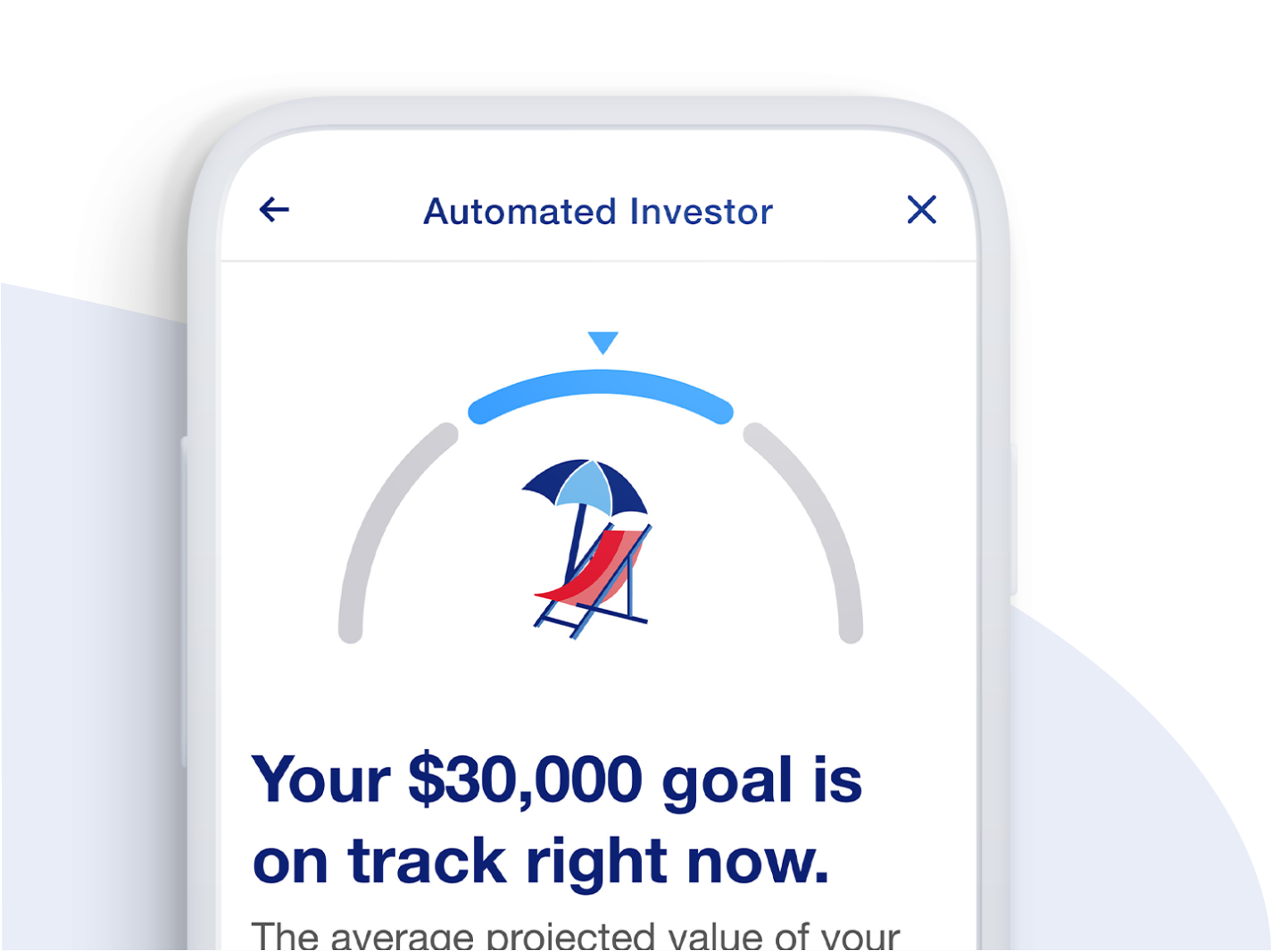

You provide the robo-advisor information about your investment goals, your comfort with financial risk and when you would like to reach your goal. The robo-advisor will monitor your mix of investments to make trades for you to help keep you on track to your goal.