Key takeaways

A review of market data going back around 90 years shows both equity and bond markets had more muted performance in the year leading up to a presidential election than at other times.

Returns after an election were also lower, especially if a new party comes into power.

Keep an eye on volatility from public policies, which tend to be contained within specific market sectors (e.g., healthcare and energy).

Every four years, the U.S. presidential election can have a major impact on policy, laws and foreign relations. But how do presidential elections affect the market? And how does that affect you?

To better understand, U.S. Bank analysts studied market data from the past 90 years and identified patterns that repeated themselves during election cycles. While these are predictions only based on historical data, this look shows how these patterns might affect your portfolio and how to weather election cycles as an investor.

The stock market and elections

A review of market data for the S&P 500* going back to the 1930s revealed certain patterns emerging over those 90 years. Analysts saw that, on average, both stock (equity) and bond markets showed more muted performance in the year leading up to a presidential election than they did at other times.

“When it’s a general election, the equity market underperforms slightly,” explains Tom Hainlin, national investment strategist at U.S. Bank. “Not to the point where we have concern for client portfolios, but that’s what we’ve seen from historical evidence.”

In any given 12-month period, the analysts saw equities generally providing gains of about 8.5%—but in the year leading up to a presidential election, gains averaged less than 6%. Bond markets provided similar results, with returns of around 6.5% in the year leading up to a presidential election, compared with their more typical 7.5% in any given 12-month period.

Stock market performance after elections

There are a few different variables that can affect the stock market performance. These are some of the changes observed when looking at the historical record for markets in the aftermath of presidential elections:

- After an election, stock market returns tend to be slightly lower for the following year, while bonds tend to outperform slightly after the election. It doesn’t seem to make much difference which party takes office, but it does matter whether control of the White House changes hands.

- When a new party comes into power, the analysts found that stock market gains averaged 5%.

- When the same president is re-elected or if one party retains control of the White House, returns were slightly higher, at 6.5%.

Stock market performance in midterm election years

When the analysts looked at data around midterm elections (elections held in between presidential elections), they found that the S&P 500 consistently outperformed in the year after midterms compared with non-midterm years. Just like presidential elections, which party controls Congress generally was not a factor in projecting overall equity market performance.

These equity and bond market trends were consistent over time unless there was a dramatic disruption. Rob Haworth, senior investment strategy director at U.S. Bank, believes the reason for this consistency is fairly straightforward: Markets do not like uncertainty. “Every four years in the U.S., we have more uncertainty,” he says, “and so the data is very explainable.”

Read more details around how midterm elections affect the stock market.

"Make sure to have all the components of a diversified portfolio in place, and then stick to a longer-term strategy that's designed for more than one election cycle."

Rob Haworth, senior investment strategy director at U.S. Bank

Specific stock market sectors to watch in election years

When it comes to elections and the markets, it’s important to keep a big-picture perspective. Eric Freedman, chief investment officer at U.S. Bank, says economic volatility from public policies tends to be contained within specific industries rather than affecting the general economy. “Usually with political issues, it’s typically not a broad market set of considerations. It tends to be more sector-focused,” he says.

Government healthcare policy seems subject to change depending on the party in power. As a result, Hainlin says the healthcare sector tends to show increased volatility leading up to a presidential election. He notes that healthcare policy is largely driven by legislators, so a new president’s healthcare vision is only likely to advance if the same party is in a position to effect legislation in Congress.

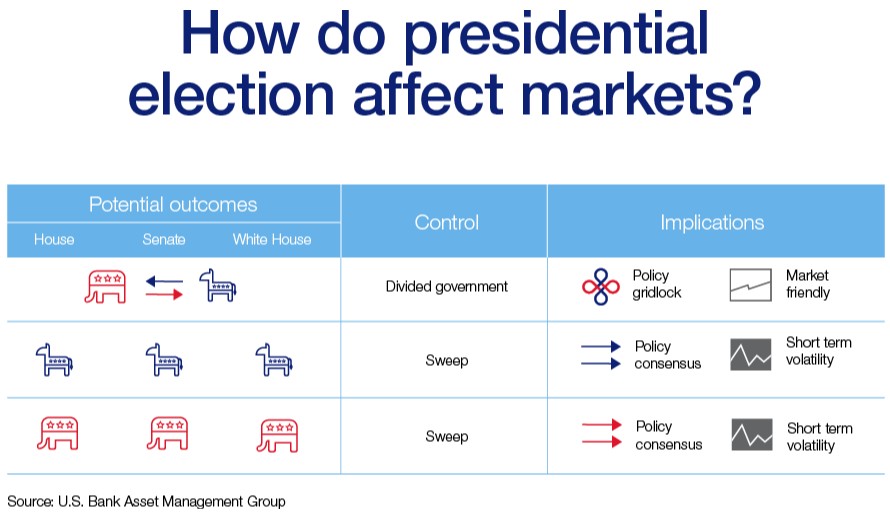

Similarly, Hainlin notes that the energy sector is often subject to increased volatility, due the differing regulatory stances of the two parties on domestic energy production and the desire to create incentives for new “green” energy sources. But more than any other policy issue, Hainlin believes trade is a key variable that is affected by election outcomes. He says it’s not just a matter of who occupies the White House (given the wide-ranging trade powers granted to the president). As is the case with other legislation, Hainlin says it can be dependent on whether the President’s party controls Congress, as the legislative arm must approve new trade deals.

After an election is over, Hainlin suggests reevaluating how the policies that are championed by newly elected officials could affect the global economy.

How to structure your portfolio to weather election years and the post-election period

Keeping an eye on which sectors are most likely to be affected by the presidential election (like healthcare) is smart. But there’s no need to panic about market volatility during election season or its aftermath. Hainlin points out that increased volatility has become more woven into the investing landscape even without the impact of elections — and that it might not necessarily spell bad news, especially when the economy is otherwise sound.

“If it’s uncertainty that causes prices to move widely, then that may also create an opportunity to buy equities,” Hainlin says. Any volatility could be used to meet your “long-term goals at a better price that can potentially give you better-than-average returns over time,” he adds.

While the drama of presidential elections can make your imagination run wild, what you need to ultimately watch is how policies will affect the domestic and global economies. Although a few investment opportunities may arise through an understanding of volatility and performance patterns in election years, Haworth says the best rule of thumb may simply be to stay invested and make sure your portfolio is rebalanced when necessary.

“Returns are made over a full business cycle, which is longer than even one presidential term,” he says. “With presidential elections, you need to make sure to have all the components of a diversified portfolio in place, and then stick to a longer-term strategy that’s designed for more than one election cycle.”

Stay up to date on the latest market news and activity.

* The Standard & Poor’s 500 (S&P 500) is a well-known, broad capitalization weighted index of U.S. stocks. The index has one of the longest histories amongst U.S. indexes.

Tags:

Related articles

Stock market under the Biden administration

Explore how capital markets have fared so far under the Biden administration and discover what to expect during the rest of the president’s first term in office.

How far will the market correction go?

With stocks slipping in and out of bear market territory, learn how the market correction and ongoing volatility could impact your investments.