Personal checking with basic banking must-haves

MONTHLY MAINTENANCE FEE

$6.95 or $0

Extra benefits for U.S. Bank credit card and loan customers

MONTHLY MAINTENANCE FEE

$14.95 or $0

Top-tier checking with competitive rates and all the perks (view rates)

MONTHLY MAINTENANCE FEE

$24.95 or $0

Personal checking with features just for students

MONTHLY MAINTENANCE FEE

$0

No monthly maintenance fee

A bank account minus the checks with no overdraft fees

MONTHLY MAINTENANCE FEE

$4.95

Monthly maintenance fee can’t be waived

text component

EMV chip card

How to use your U.S. Bank Voyager Mastercard with an EMV® chip

Learn how to correctly use fleet EMV chip cards at point-of-sale devices.

Note: Reg mark is TINY when superscripted and as a result vertical alignment with EMV looks off.

accordion component

Frequently asked questions on how to use your U.S. Bank Voyager Mastercard with an EMV® chip

Note: Reg mark is TINY when superscripted and as a result vertical alignment with EMV looks off.

Gold Checking Package details

Monthly maintenance fee

$0 or $14.95

How to waive the monthly maintenance fee

Your monthly maintenance fee can be waived if you have an open U.S. Bank personal loan, line, mortgage or credit card.1

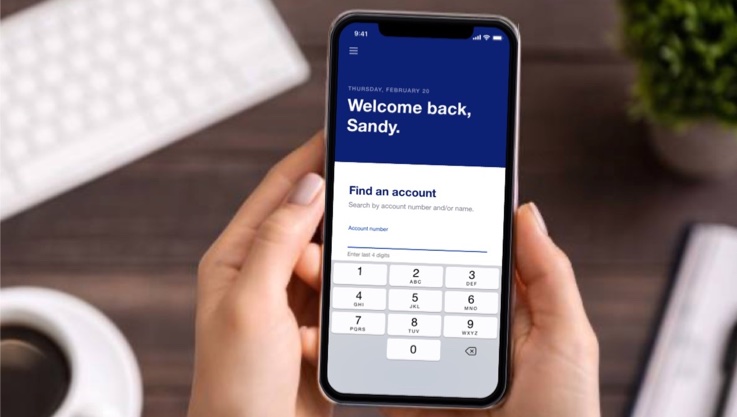

Enjoy a U.S. Bank Visa® Debit Card, mobile and online banking with mobile check deposit,4 bill pay and more.